How To Send Money: A Comprehensive Guide To Safe, Efficient, And Cost-Effective Transfers

How Can I Send Money is a question that arises in various situations, such as repaying debts, transferring funds for purchases, or supporting loved ones. The advent of digital payment technologies has revolutionized the way we send money, providing greater convenience and accessibility compared to traditional methods like cash or checks.

The ability to send money swiftly and securely has numerous benefits. It eliminates the risks associated with carrying large amounts of cash, reduces transaction fees, and provides a convenient way to manage finances. Historically, the development of wire transfer systems in the 19th century marked a significant turning point, enabling the transfer of funds across vast distances.

In this article, we will explore the diverse options available for sending money. We will examine the advantages and limitations of each method, including bank transfers, mobile payments, and online platforms. By providing a comprehensive overview, we aim to empower individuals with the knowledge and strategies to send money effectively and efficiently.

How Can I Send Money

Understanding the essential aspects of sending money is crucial for navigating the diverse options available and making informed decisions. These aspects encompass various dimensions, including:

- Method: Bank transfer, mobile payment, online platform

- Fees: Transaction costs, currency conversion charges

- Speed: Time taken for funds to be transferred

- Security: Measures to protect against fraud and unauthorized access

- Convenience: Accessibility, user-friendliness

- Limits: Maximum amount that can be sent per transaction

- Exchange rates: Impact on cross-border transfers

- Recipient's location: Domestic or international transfers

- Purpose: Personal, business, or other reasons

These aspects are interconnected and influence the choice of money transfer method. For instance, a bank transfer may offer lower fees but slower speed, while a mobile payment service may provide greater convenience but higher transaction costs. Understanding these nuances empowers individuals to select the most suitable option based on their specific needs and circumstances.

Method

The choice of method for sending money has a significant impact on factors such as convenience, cost, speed, and security. Three primary methods are commonly used: bank transfer, mobile payment, and online platform.

- Bank transfer

Bank transfer involves sending money from one bank account to another. It is a widely accepted and secure method, but it can be slow and may incur fees, especially for international transfers. - Mobile payment

Mobile payment services allow users to send and receive money using their mobile devices. They offer convenience and speed, but may have limitations in terms of transaction limits and fees. - Online platform

Online platforms provide a digital interface for sending money domestically and internationally. They often offer competitive exchange rates and low fees, but may require users to create an account and provide personal information.

The choice of method ultimately depends on the specific needs and preferences of the sender. For large amounts or international transfers, bank transfers may be preferred for their security and reliability. Mobile payments are ideal for small, quick transfers, while online platforms offer a balance of convenience, cost-effectiveness, and flexibility.

Fees

Transaction costs and currency conversion charges are inherent components of sending money, significantly impacting the overall process. These fees can vary depending on the method of transfer, the amount being sent, and the currency exchange rates. Understanding the implications of these fees is crucial for making informed decisions and optimizing the money transfer process.

Transaction costs are levied by banks or money transfer services to cover the expenses incurred in processing the transfer. These costs may include wire transfer fees, international transfer fees, and currency conversion fees. Currency conversion charges arise when the sender and recipient use different currencies. The exchange rate used for the conversion can affect the total amount received by the recipient.

For instance, sending a large amount of money internationally may incur a higher transaction fee compared to a smaller domestic transfer. Similarly, transferring money to a country with a different currency can result in currency conversion charges that reduce the amount received by the recipient. It is important to compare the fees charged by different money transfer services and choose the option that offers the most cost-effective solution for the specific transfer needs.

Understanding the relationship between fees and money transfer options empowers individuals to make informed decisions, minimize costs, and ensure that their funds are transferred efficiently and securely. By considering the impact of transaction costs and currency conversion charges, individuals can optimize their money transfer experiences.

Speed

In the realm of money transfer, speed plays a pivotal role, influencing the accessibility, convenience, and efficiency of the process. Understanding the time taken for funds to be transferred is crucial for individuals seeking to optimize their money transfer experiences.

- Transaction processing time

This refers to the time taken by the sender's bank or money transfer service to process the transfer request. It can vary depending on the method used, internal bank procedures, and regulatory checks.

- Network transfer time

Once the transfer is processed, the funds are sent through a network to the recipient's bank. The speed of this transfer depends on the efficiency of the network and the distance between the sender's and recipient's banks.

- Recipient's bank processing time

Upon reaching the recipient's bank, the funds are subject to further processing, which may include currency conversion, account verification, and other checks. This can also impact the overall transfer speed.

- Business hours and holidays

It's important to consider that bank transfers and other money transfer services may be subject to business hours and holidays. This can affect the speed of the transfer, especially if it is initiated outside of normal operating hours.

Understanding these facets of speed empowers individuals to make informed decisions when choosing a money transfer method. For urgent transfers, real-time payment systems or mobile payment services may be preferred. For larger transfers or international transfers, bank transfers may be a more secure and reliable option, although they may take longer. By considering the implications of speed on the overall money transfer process, individuals can ensure timely and efficient delivery of funds.

Security

In the digital age, security measures play a critical role in ensuring the safety and integrity of online money transfers. "Security: Measures to protect against fraud and unauthorized access" is an essential component of "How Can I Send Money" as it safeguards sensitive financial information and protects users from malicious activities. Without robust security measures, the process of sending money online could expose users to various risks, including identity theft, financial loss, and account compromise.

Real-life examples of security measures implemented in money transfer systems include encryption technologies, two-factor authentication, and fraud detection systems. Encryption ensures that data is transmitted securely, while two-factor authentication adds an extra layer of protection by requiring users to provide a second form of identification, such as a one-time password sent to their mobile phone. Fraud detection systems monitor transactions for suspicious activity and can block unauthorized access to accounts.

Understanding the importance of security measures empowers individuals to take proactive steps to protect themselves when sending money online. By choosing reputable money transfer services that prioritize security, using strong passwords and enabling two-factor authentication, individuals can minimize the risk of fraud and unauthorized access. Additionally, being aware of common scams and phishing attempts can help users avoid falling prey to malicious actors.

In summary, "Security: Measures to protect against fraud and unauthorized access" is a critical aspect of "How Can I Send Money" as it safeguards users from financial risks and protects the integrity of online money transfers. By implementing robust security measures and educating users about potential threats, money transfer services can create a secure environment for sending money online.

Convenience

In the context of "How Can I Send Money", convenience plays a pivotal role in enhancing the overall user experience. Accessibility and user-friendliness are fundamental components of convenience, directly impacting the ease and efficiency of money transfer processes. Accessible money transfer services ensure that individuals can send money from various locations and devices, without encountering barriers or limitations.

User-friendly interfaces, clear instructions, and intuitive navigation contribute to a seamless money transfer experience. By simplifying the process, user-friendly services reduce the likelihood of errors and frustrations, empowering users to complete their transactions swiftly and effortlessly. Real-life examples of convenience in money transfer include mobile payment applications that allow users to send money with a few taps on their smartphones, online platforms that provide step-by-step guidance throughout the transfer process, and 24/7 customer support to assist users with any queries or difficulties.

Understanding the connection between convenience and "How Can I Send Money" has practical significance. Accessible and user-friendly money transfer services encourage financial inclusion by enabling individuals with varying levels of digital literacy and technical expertise to participate in the formal financial system. Convenient services also promote financial independence, as users can send money anytime, anywhere, without being constrained by physical or geographical limitations. Moreover, convenience contributes to user satisfaction and loyalty, as customers are more likely to choose and continue using services that offer a seamless and hassle-free experience.

In summary, "Convenience: Accessibility, user-friendliness" is a critical component of "How Can I Send Money", as it directly impacts the ease, efficiency, and inclusivity of money transfer processes. By prioritizing convenience, money transfer services can empower users, promote financial inclusion, and enhance the overall customer experience.

Limits

The relationship between "Limits: Maximum amount that can be sent per transaction" and "How Can I Send Money" is significant. Transaction limits directly impact the planning and execution of money transfers, influencing the choice of money transfer methods and the overall efficiency of the process.

Transaction limits can arise due to various factors, including regulatory compliance, risk management policies, and the capabilities of the money transfer platform or service. These limits may vary depending on the sender's location, the recipient's country, the amount being sent, and the method of transfer. Understanding these limits is crucial to avoid delays or complications during the money transfer process.

Real-life examples of transaction limits in "How Can I Send Money" include daily limits on mobile payment applications, weekly limits on online money transfer platforms, and country-specific limits imposed by banks and financial institutions. These limits can affect individuals who need to send large amounts of money or make frequent transfers.

The practical significance of understanding transaction limits lies in enabling individuals to plan their money transfers effectively. By being aware of the limits, they can choose the most appropriate money transfer method and avoid the disappointment of having their transfers declined or delayed due to exceeding the limits. Additionally, understanding transaction limits can help individuals optimize their money transfer strategies, such as breaking down large transfers into smaller, more manageable amounts to bypass limits.

In summary, "Limits: Maximum amount that can be sent per transaction" is a critical component of "How Can I Send Money" as it influences the planning, execution, and efficiency of money transfers. Understanding these limits empowers individuals to make informed decisions, avoid potential challenges, and optimize their money transfer experiences.

Exchange rates

Exchange rates play a critical role in cross-border money transfers, significantly impacting the amount received by the recipient. The exchange rate is the value of one currency in relation to another, and it can fluctuate frequently based on various economic factors. Understanding the impact of exchange rates is essential for individuals and businesses sending money across borders.

When sending money to a different country, the sender's currency must be converted into the recipient's currency. The exchange rate determines how much of the recipient's currency is received for each unit of the sender's currency. Fluctuations in exchange rates can lead to variations in the amount received, even if the sender sends the same amount of money. For example, if the exchange rate between the US dollar and the Euro increases, the recipient in Europe will receive more Euros for the same amount of US dollars sent.

Real-life examples of exchange rate impact on cross-border transfers are abundant. Individuals sending money to family or friends abroad may find that the amount received varies depending on the exchange rate at the time of transfer. Businesses engaged in international trade and e-commerce need to consider exchange rate fluctuations when pricing their products or services.

Understanding the practical significance of exchange rates empowers individuals and businesses to make informed decisions when sending money across borders. By monitoring exchange rate trends and choosing the most favorable time to transfer funds, they can optimize the amount received by the recipient. Additionally, using currency exchange services that offer competitive exchange rates can further enhance the cost-effectiveness of cross-border money transfers.

Recipient's location

The location of the recipient plays a critical role in determining the methods and processes involved in sending money. Understanding the distinction between domestic and international transfers is essential for individuals seeking to send money efficiently and securely.

Domestic transfers, which occur within the same country, are generally simpler and less expensive than international transfers. Common methods for domestic transfers include bank transfers, mobile payment applications, and online platforms. These methods offer convenience and speed, with funds typically being transferred within a short period.

International transfers, on the other hand, involve sending money across borders, which introduces additional complexities. Factors such as currency exchange rates, transfer fees, and regulatory requirements come into play. International transfers may require more time to complete and can be subject to higher fees compared to domestic transfers. The choice of method for international transfers depends on factors such as the amount being sent, the urgency of the transfer, and the availability of services in both the sender's and recipient's countries.

Understanding the implications of the recipient's location empowers individuals to choose the most appropriate method for sending money. By considering factors such as cost, speed, security, and convenience, individuals can optimize their money transfer experiences and ensure that funds reach the recipient in a timely and efficient manner.

Purpose

The purpose of sending money plays a significant role in determining the most appropriate method and platform to use. Understanding the different reasons for sending money empowers individuals to make informed decisions and optimize their money transfer experiences.

- Personal

Sending money for personal reasons encompasses a wide range of purposes, such as supporting family and friends, gifting funds for special occasions, or making charitable donations. Personal transfers are often characterized by smaller amounts and a focus on convenience and speed.

- Business

Business-related money transfers involve transactions between companies, individuals, and organizations. They can include payments for goods and services, salaries and wages, and investments. Business transfers typically require higher levels of security and may involve larger amounts of money.

- Other reasons

Beyond personal and business purposes, individuals may also need to send money for other reasons, such as paying rent or utilities, making loan payments, or contributing to crowdfunding campaigns. These transfers can vary in terms of amount and urgency, requiring flexible and accessible money transfer options.

Understanding the purpose of sending money helps individuals choose the most suitable money transfer method based on factors such as cost, speed, security, and convenience. By considering the specific purpose of their transfer, individuals can optimize their experiences and ensure that their funds reach the intended recipient efficiently and securely.

In exploring the multifaceted topic of "How Can I Send Money", this article has shed light on the diverse methods, factors, and considerations involved in money transfer processes. Key ideas that emerge include the interplay of convenience, cost, speed, security, and purpose in shaping the choice of money transfer options. Understanding the implications of each aspect empowers individuals to optimize their money transfer experiences and make informed decisions.

Several main points stand out in this discussion. Firstly, the choice of money transfer method hinges on the specific needs and preferences of the sender. Bank transfers offer a secure and reliable option, while mobile payments prioritize convenience and speed. Online platforms provide a balance of cost-effectiveness and flexibility. Secondly, factors such as transaction fees, exchange rates, and transfer limits can significantly impact the overall cost and efficiency of money transfers. Understanding these factors allows individuals to minimize expenses and choose the most cost-effective option. Thirdly, the purpose of the transfer, whether personal, business, or other, influences the choice of method and platform. Each purpose has unique requirements, and tailoring the transfer method accordingly ensures a smooth and efficient process.

The ability to send money efficiently and securely is a cornerstone of modern financial systems. As technology continues to advance and new money transfer options emerge, individuals must remain informed and adaptable to leverage the best solutions. By understanding the key aspects of "How Can I Send Money", individuals can navigate the complexities of money transfers, optimize their experiences, and ensure that their funds reach their intended destinations safely and cost-effectively.

- Miguel Alberto Martin Obituary

- Missing Evelyn Guardado S Remains Likely Found

- Alta Semper Zachary Fond What

How to Send Money to Someone Without a Bank Account

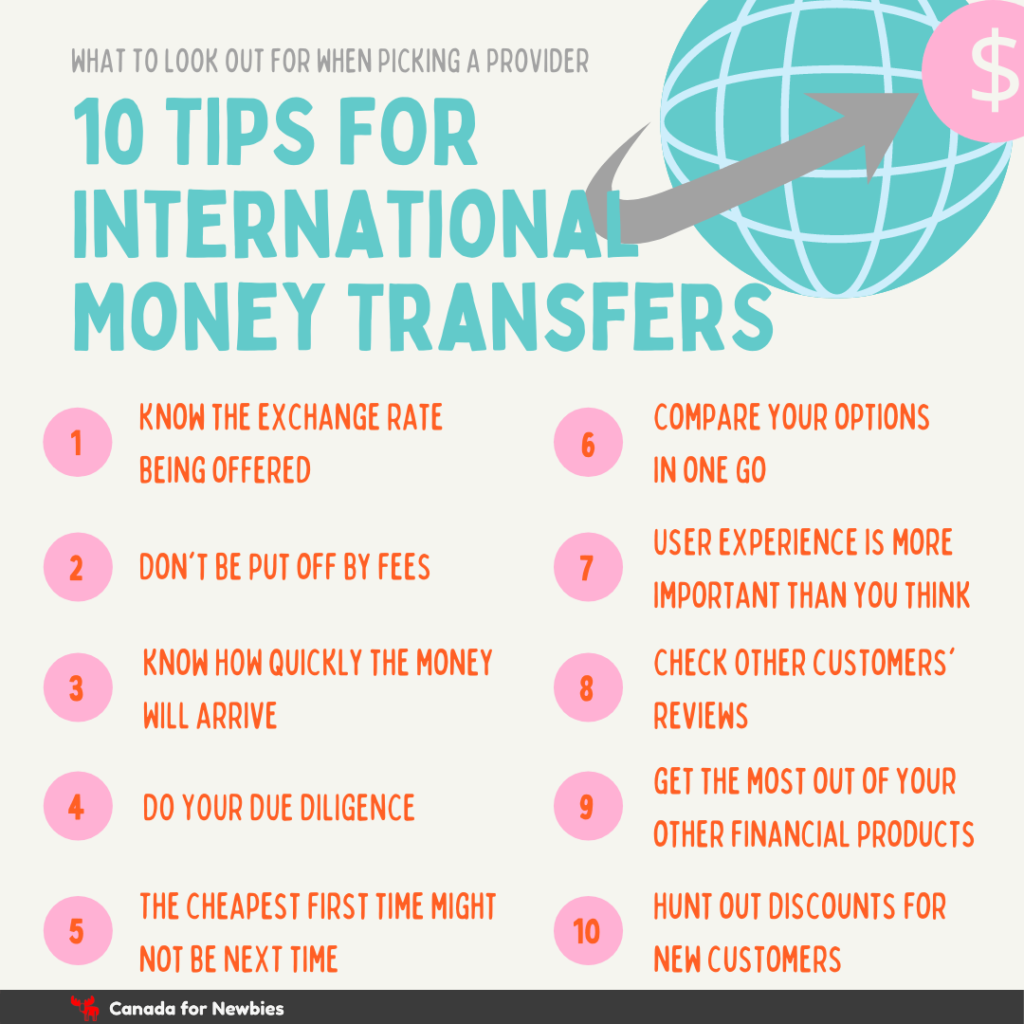

Best way to send money internationally options & top 10 tips Canada

FNB launches Zimbabwe and Mozambique Money Transfers on its Banking App