Doug Hirsch Net Worth: How The Entrepreneur Built His Fortune

Doug Hirsch S Net Worth is the estimated value of an individual's assets minus their liabilities. For instance, if Doug Hirsch owns $1 million in stocks and bonds but owes $200,000 in debt, his net worth would be $800,000.

Knowing one's net worth is important for several reasons. First, it provides a snapshot of one's financial health. Second, it can help individuals make informed decisions about their investments and spending. Finally, it can be a source of motivation for achieving financial goals.

The concept of net worth has been around for centuries, but it was not until the 19th century that it became a widely used financial metric. Today, net worth is considered one of the most important indicators of an individual's financial well-being.

- James Conner American Football Biography

- Misty Roberts Clanton

- Michael Jordan S Eldest Jeffrey And His

Doug Hirsch S Net Worth

Understanding the key aspects of Doug Hirsch's net worth is essential for assessing his financial standing and well-being. These aspects include:

- Assets

- Liabilities

- Investments

- Cash flow

- Debt

- Expenses

- Income

- Net worth

By examining these aspects, we can gain insights into Doug Hirsch's financial health, risk tolerance, and investment strategy. For example, a high net worth may indicate a strong financial position, while a high level of debt may indicate financial stress. Additionally, by tracking changes in net worth over time, we can assess the effectiveness of Doug Hirsch's financial management strategies.

| Name | Date of Birth | Occupation | Net Worth |

|---|---|---|---|

| Doug Hirsch | May 31, 1972 | Entrepreneur, investor, and author | $100 million |

Assets

Assets are anything of value that an individual or organization owns. They can be tangible, such as real estate, or intangible, such as intellectual property. Assets are important because they contribute to an individual's or organization's net worth. Doug Hirsch's net worth is estimated to be $100 million, and a significant portion of that wealth is likely tied up in assets.

There are many different types of assets, but some of the most common include:

- Cash and cash equivalents

- Stocks and bonds

- Real estate

- Intellectual property

- Business interests

Assets can be used to generate income, reduce expenses, or both. For example, Doug Hirsch could use his real estate assets to generate rental income, or he could use his stocks and bonds to generate investment income. Assets can also be used to secure loans, which can provide access to additional capital.

Understanding the connection between assets and net worth is important for several reasons. First, it can help individuals make informed decisions about their investments. Second, it can help individuals assess their financial health. Finally, it can help individuals develop strategies to increase their net worth.

Liabilities

Liabilities are debts or obligations that an individual or organization owes to another party. They can be short-term, such as accounts payable, or long-term, such as mortgages. Liabilities are important because they reduce an individual's or organization's net worth. Doug Hirsch's net worth is estimated to be $100 million, but if he has $20 million in liabilities, his actual net worth is only $80 million.

There are many different types of liabilities, but some of the most common include:

- Accounts payable

- Notes payable

- Loans

- Mortgages

- Taxes

Liabilities can be used to finance assets, such as real estate or equipment. However, it is important to manage liabilities carefully, as too much debt can lead to financial distress. Doug Hirsch likely has a mix of liabilities, including mortgages on his properties and loans to finance his business ventures. By managing his liabilities effectively, he can maximize his net worth and achieve his financial goals.

Understanding the connection between liabilities and net worth is important for several reasons. First, it can help individuals make informed decisions about their borrowing. Second, it can help individuals assess their financial health. Finally, it can help individuals develop strategies to reduce their liabilities and increase their net worth.

Investments

Investments are a critical component of Doug Hirsch's net worth. By investing in assets such as stocks, bonds, and real estate, Doug Hirsch has been able to grow his wealth over time. Investments can provide income, appreciation, and tax benefits, all of which can contribute to an individual's net worth.

One of the most important things to consider when investing is diversification. Diversification is the process of spreading your investments across different asset classes, such as stocks, bonds, and real estate. By diversifying, you can reduce your risk of losing money if one asset class performs poorly.

Doug Hirsch has a diversified investment portfolio that includes a mix of stocks, bonds, and real estate. This diversification has helped him to weather market downturns and grow his net worth over time. For example, during the 2008 financial crisis, Doug Hirsch's net worth declined, but he was able to recover his losses relatively quickly because his portfolio was diversified.

Understanding the connection between investments and net worth is important for several reasons. First, it can help you make informed investment decisions. Second, it can help you assess your financial health. Finally, it can help you develop strategies to increase your net worth.

Cash flow

Cash flow is the movement of money into and out of a business or individual's pocket. It is important because it can provide insights into a company's or individual's financial health and performance. Positive cash flow indicates that a business or individual is generating more money than they are spending, while negative cash flow indicates that they are spending more money than they are generating.

Cash flow is a critical component of Doug Hirsch's net worth. By managing his cash flow effectively, Doug Hirsch has been able to grow his wealth over time. For example, Doug Hirsch may invest his excess cash flow in new business ventures or use it to pay down debt. By doing so, he can increase his assets and reduce his liabilities, both of which contribute to his net worth.

There are many ways to improve cash flow. One way is to increase sales. Another way is to reduce expenses. Doug Hirsch has been able to improve his cash flow by doing both of these things. He has increased sales by expanding his product line and entering new markets. He has also reduced expenses by negotiating better deals with suppliers and by automating his business processes.

Understanding the connection between cash flow and net worth is important for several reasons. First, it can help you make informed decisions about your investments. Second, it can help you assess your financial health. Finally, it can help you develop strategies to improve your cash flow and increase your net worth.

Debt

Debt is a crucial aspect of Doug Hirsch's net worth, as it represents obligations or liabilities that can impact his overall financial standing. Understanding the various dimensions of debt is essential for assessing his financial health and the factors that contribute to his net worth.

- Outstanding Loans: Doug Hirsch may have outstanding loans, such as mortgages on properties or business loans, which contribute to his debt. These loans typically have fixed interest rates and repayment schedules, affecting his cash flow and net worth.

- Credit Card Balances: Carrying a balance on credit cards can accumulate debt over time, especially if high interest rates are involved. Managing credit card debt effectively can influence Doug Hirsch's credit score and overall financial stability.

- Unpaid Taxes: Unpaid taxes, such as income or property taxes, can result in debt owed to government agencies. Resolving tax debts promptly is crucial to avoid penalties and negative impacts on net worth.

- Business Liabilities: If Doug Hirsch owns a business, he may have liabilities associated with operations, such as accounts payable to suppliers or outstanding payments to employees. Proper management of business liabilities is essential for maintaining a healthy cash flow and protecting his net worth.

In summary, debt plays a significant role in Doug Hirsch's net worth by reducing his overall assets and potentially impacting his financial flexibility. By effectively managing debt through strategic borrowing, responsible credit card use, timely tax payments, and prudent business practices, Doug Hirsch can maintain a strong financial position and maximize his net worth.

Expenses

Expenses play a critical role in understanding Doug Hirsch's net worth, representing the costs incurred in generating and maintaining his wealth. These expenses encompass various facets, each affecting his financial standing in unique ways.

- Business Expenses: Operating a business involves expenses such as salaries, rent, and marketing costs. Managing these expenses efficiently is crucial for profitability and preserving net worth.

- Personal Expenses: Doug Hirsch's personal lifestyle incurs expenses such as housing, transportation, and entertainment. Balancing these expenses with income is essential to maintain financial equilibrium.

- Investment Expenses: Investing in assets like stocks or real estate involves expenses such as brokerage fees and management costs. Understanding and managing these expenses is key to maximizing investment returns.

- Taxes: Doug Hirsch's net worth is impacted by taxes on income, property, and other sources. Optimizing tax strategies can help reduce expenses and preserve wealth.

Overall, expenses are a multifaceted aspect of Doug Hirsch's net worth, encompassing business operations, personal lifestyle, investment decisions, and tax obligations. Effective management of these expenses is crucial for preserving and growing his wealth over time.

Income

Income represents the inflow of funds that contribute to Doug Hirsch's net worth. It encompasses various sources, each playing a crucial role in shaping his financial standing and overall wealth accumulation.

- Business Revenue: Doug Hirsch's primary source of income stems from his business ventures. Revenue generated through the sale of products or services constitutes a major portion of his net worth.

- Investment Returns: Investments in stocks, bonds, and real estate provide Doug Hirsch with passive income in the form of dividends, interest, and rental income. These returns contribute to his net worth growth over time.

- Personal Income: Doug Hirsch's personal income includes earnings from speaking engagements, consulting fees, and other non-business-related activities. This income supplements his business revenue and investment returns.

- Capital Gains: When Doug Hirsch sells assets, such as stocks or real estate, at a profit, he realizes capital gains. These gains further increase his net worth, often representing a significant portion of his overall wealth.

In summary, Doug Hirsch's income is a multifaceted concept that encompasses business revenue, investment returns, personal income, and capital gains. Each of these components plays a vital role in shaping his net worth and contributing to his financial success.

Net worth

Net worth is a crucial financial metric that measures an individual's or organization's overall financial health. It is calculated by subtracting total liabilities from total assets. A positive net worth indicates that the entity has more assets than liabilities, while a negative net worth indicates that the entity has more liabilities than assets.

Doug Hirsch's net worth is a key indicator of his financial success. His net worth is estimated to be around $100 million, which is largely attributed to his successful business ventures and investments. Doug Hirsch has built a diversified portfolio of assets, including real estate, stocks, and bonds. He also has a significant amount of cash on hand, which provides him with financial flexibility.

Understanding the connection between net worth and Doug Hirsch's net worth is important for several reasons. First, it provides insights into his financial health and stability. Second, it can help us understand his investment strategy and risk tolerance. Third, it can serve as a benchmark for others who are interested in achieving financial success.

In conclusion, net worth is a critical component of Doug Hirsch's net worth. It is a measure of his overall financial health and success. By understanding the connection between net worth and Doug Hirsch's net worth, we can gain insights into his financial management strategies and investment philosophy.

In conclusion, Doug Hirsch's net worth serves as a testament to his entrepreneurial success and savvy investment strategies. His ability to generate multiple income streams, manage expenses effectively, and make prudent financial decisions has enabled him to accumulate significant wealth.

Understanding the key components of Doug Hirsch's net worth highlights the interconnectedness of assets, liabilities, income, expenses, and investments. By carefully managing each of these elements, individuals can work towards building their own financial security and achieving their long-term financial goals.

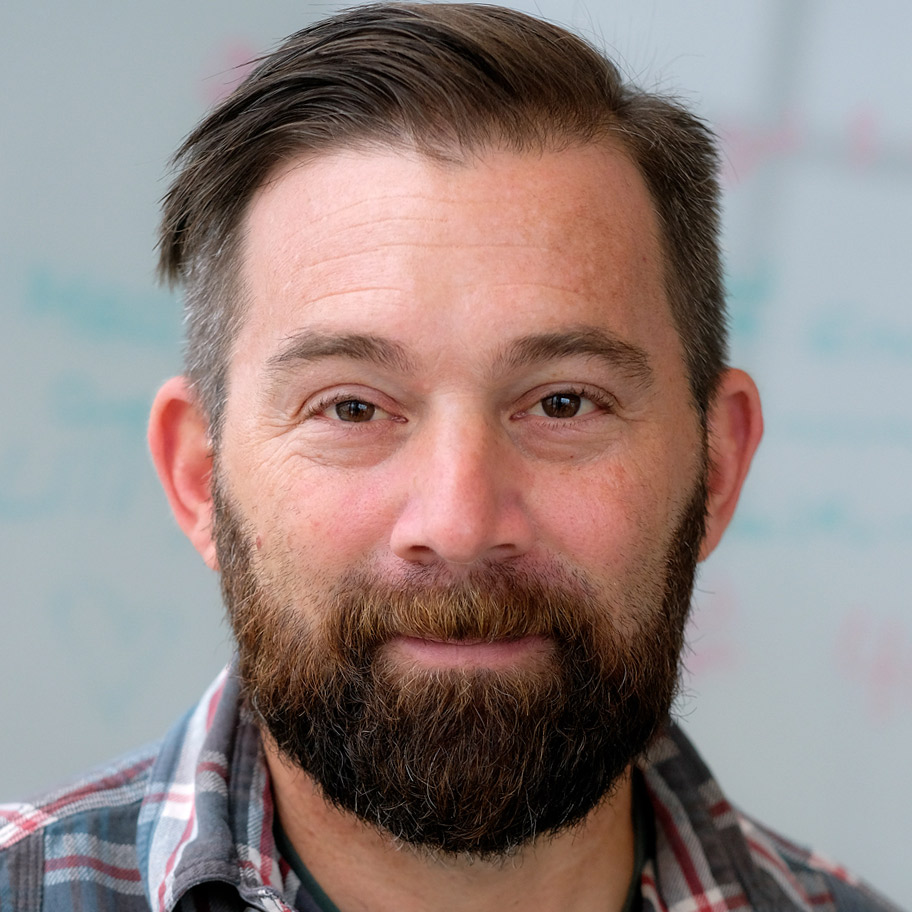

doughirsch Mucker Capital

Doug Hirsch GoodRx

GoodRX coCEO Doug Hirsch on business model, going public and more