How To Determine Chuck's Financial Status

"How Much Money Does Chuck" is an interrogative phrase used to inquire about the financial status of an individual named Chuck. For instance, if you ask, "How much money does Chuck make?", you seek information about Chuck's income.

Understanding the financial situation of individuals like Chuck can be significant for decision-making in various contexts, such as lending or investing. Additionally, historical developments, such as the growth of financial literacy, have influenced the relevance of this question.

This article delves into the factors that determine Chuck's financial status, explores the benefits of financial literacy, and examines historical events that have shaped our understanding of personal finance.

How Much Money Does Chuck

Understanding the various aspects that contribute to an individual's financial status is crucial for assessing their overall financial well-being. In the case of Chuck, several key aspects come into play when evaluating "How Much Money Does Chuck" have.

- Income

- Assets

- Liabilities

- Investments

- Savings

- Expenses

- Financial Goals

- Risk Tolerance

- Investment Strategy

- Tax Implications

These aspects are interconnected and influence Chuck's overall financial picture. By considering each aspect in detail, we can gain a comprehensive understanding of Chuck's financial situation and make informed decisions regarding lending, investing, or other financial matters.

Income

Income plays a central role in determining "How Much Money Does Chuck" have. It represents the amount of money Chuck earns from various sources, such as employment, self-employment, investments, or government benefits. Income is a critical component of Chuck's financial status as it directly impacts his ability to meet expenses, save money, and invest for the future.

- Amanda Schull Movies And Tv Shows

- Lebron Cant Believe This Is My Life

- Rob Murray Footballer S Biography

The relationship between income and "How Much Money Does Chuck" have is straightforward: higher income generally leads to a higher amount of money Chuck has. This is because income provides the resources necessary to cover expenses, build savings, and make investments. Without a sufficient income, Chuck may face challenges in meeting his financial obligations and achieving his financial goals.

In practical terms, understanding the connection between income and "How Much Money Does Chuck" have is essential for making informed financial decisions. For example, if Chuck is considering applying for a loan, lenders will evaluate his income to assess his ability to repay the debt. Similarly, if Chuck is planning to invest in a new business venture, he will need to consider whether his income is sufficient to support the investment and manage any potential risks.

In summary, income is a key determinant of "How Much Money Does Chuck" have. A higher income provides Chuck with more financial flexibility and opportunities, while a lower income may limit his financial capacity. Understanding this relationship is crucial for making informed financial decisions and achieving financial well-being.

Assets

Assets play a critical role in determining "How Much Money Does Chuck" have. Assets are resources or items of value that Chuck owns or controls. They can be tangible, such as real estate, vehicles, or equipment, or intangible, such as stocks, bonds, or intellectual property. Assets are important because they represent potential sources of income, future value, or financial security.

The relationship between assets and "How Much Money Does Chuck" have is direct and positive: the more assets Chuck has, the more money he has. This is because assets can be liquidated or used as collateral to generate income or obtain financing. For example, Chuck can rent out a property he owns to generate rental income, or he can sell stocks to raise capital for a new investment.

In practical terms, understanding the connection between assets and "How Much Money Does Chuck" have is essential for making informed financial decisions. For example, if Chuck is considering applying for a loan, lenders will evaluate his assets to assess his ability to repay the debt. Similarly, if Chuck is planning to retire early, he will need to consider whether his assets are sufficient to support his desired lifestyle.

In summary, assets are a key component of "How Much Money Does Chuck" have. They provide Chuck with financial flexibility, security, and the potential for future wealth creation. Understanding the relationship between assets and "How Much Money Does Chuck" have is crucial for making informed financial decisions and achieving financial well-being.

Liabilities

Liabilities are financial obligations that Chuck owes to other individuals or organizations. They represent the amount of money Chuck is legally bound to pay back. Common examples of liabilities include mortgages, car loans, credit card debt, and unpaid taxes.

The relationship between liabilities and "How Much Money Does Chuck" have is inverse: the more liabilities Chuck has, the less money he has. This is because liabilities reduce Chuck's net worth by decreasing his assets or increasing his expenses. For example, if Chuck takes out a mortgage to buy a house, the mortgage balance becomes a liability that reduces his net worth. Similarly, if Chuck has unpaid credit card debt, the interest charges on the debt increase his expenses, which can also reduce his net worth.

In practical terms, understanding the connection between liabilities and "How Much Money Does Chuck" have is essential for making informed financial decisions. For example, if Chuck is considering applying for a loan, lenders will evaluate his liabilities to assess his ability to repay the debt. Similarly, if Chuck is planning to retire early, he will need to consider whether his liabilities are low enough to allow him to live comfortably on his retirement income.

In summary, liabilities are a critical component of "How Much Money Does Chuck" have. They represent financial obligations that reduce Chuck's net worth and can limit his financial flexibility. Understanding the relationship between liabilities and "How Much Money Does Chuck" have is crucial for making informed financial decisions and achieving financial well-being.

Investments

Investments are a crucial aspect of "How Much Money Does Chuck" have. They represent the portion of Chuck's assets that are allocated to generating future income or capital appreciation. By investing, Chuck can potentially increase his wealth over time and secure his financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies. When Chuck invests in stocks, he becomes a part-owner of the company and is entitled to a share of its profits (dividends) and potential capital gains (increase in stock value).

- Bonds

Bonds are loans that Chuck makes to governments or corporations. In return for lending the money, Chuck receives regular interest payments and gets back the principal amount when the bond matures.

- Real Estate

Real estate investments involve purchasing properties, such as houses, apartments, or land. Chuck can generate income from real estate through rent or by selling the property for a profit.

- Mutual Funds

Mutual funds are professionally managed investment funds that pool money from multiple investors and invest in a diversified portfolio of stocks, bonds, or other assets. They offer investors a convenient and low-cost way to gain exposure to a variety of investments.

The types of investments that Chuck chooses, as well as the performance of those investments, can significantly impact "How Much Money Does Chuck" have. By understanding the different investment options available and making informed investment decisions, Chuck can increase his chances of achieving his financial goals.

Savings

Savings represent a critical component of "How Much Money Does Chuck" have. They refer to the portion of Chuck's income that he does not spend and instead sets aside for future use. Savings are essential for achieving financial stability, security, and long-term financial goals.

The relationship between savings and "How Much Money Does Chuck" have is direct and positive: the more Chuck saves, the more money he has. This is because savings accumulate over time, providing Chuck with a growing pool of financial resources. Chuck can use his savings to cover unexpected expenses, invest for the future, or supplement his income during retirement.

In practical terms, understanding the connection between savings and "How Much Money Does Chuck" have is crucial for making informed financial decisions. For example, if Chuck is considering applying for a loan, lenders will evaluate his savings to assess his financial responsibility and ability to repay the debt. Similarly, if Chuck is planning to retire early, he will need to consider whether his savings are sufficient to support his desired lifestyle.

In summary, savings are a key determinant of "How Much Money Does Chuck" have. They provide Chuck with financial flexibility, security, and the ability to achieve his long-term financial goals. Understanding the relationship between savings and "How Much Money Does Chuck" have is essential for making informed financial decisions and achieving financial well-being.

Expenses

Expenses play a significant role in determining "How Much Money Does Chuck" have. Expenses represent the costs incurred by Chuck in the process of earning and maintaining his income and lifestyle. These costs can be fixed, such as rent or mortgage payments, or variable, such as groceries or entertainment expenses.

The relationship between expenses and "How Much Money Does Chuck" have is inverse: the more expenses Chuck has, the less money he has available. This is because expenses reduce Chuck's disposable income, which is the amount of money he has left after paying for his expenses. For example, if Chuck has high housing expenses, he may have less money available for savings or investments.

Understanding the connection between expenses and "How Much Money Does Chuck" have is crucial for making informed financial decisions. By tracking his expenses, Chuck can identify areas where he can reduce spending and free up more money for savings, investments, or other financial goals. Expense tracking can also help Chuck identify unnecessary or excessive expenses that he can eliminate or reduce. Practical applications of this understanding include creating a budget, negotiating lower expenses, and finding ways to increase income.

In summary, expenses are a critical component of "How Much Money Does Chuck" have. By understanding the relationship between expenses and "How Much Money Does Chuck" have, Chuck can make informed decisions about his spending and improve his overall financial well-being.

Financial Goals

Understanding "Financial Goals" is crucial in determining "How Much Money Does Chuck" have. Financial goals represent Chuck's aspirations and objectives for his financial future, serving as a roadmap for managing his money and making informed financial decisions.

- Retirement Planning

Retirement planning involves setting aside funds to ensure a financially secure retirement. Chuck's retirement goals will influence how much money he needs to save and invest now to maintain his desired lifestyle in the future.

- Education Funding

Education funding goals focus on saving for the future education expenses of Chuck or his family members. This can include college tuition, graduate school costs, or specialized training programs.

- Homeownership

Homeownership goals involve saving for a down payment and other expenses associated with purchasing a home. Owning a home can be a significant financial investment and a key component of Chuck's long-term financial plan.

- Emergency Fund

An emergency fund is a crucial financial goal that involves setting aside money for unexpected events, such as job loss, medical emergencies, or home repairs. Having an emergency fund can prevent Chuck from relying on debt or depleting his savings in times of financial stress.

By setting clear financial goals and aligning his financial decisions with those goals, Chuck can increase his chances of achieving financial stability, security, and long-term success. The specific financial goals that Chuck pursues will depend on his individual circumstances, priorities, and risk tolerance.

Risk Tolerance

Risk tolerance is a crucial factor in determining "How Much Money Does Chuck" have. It represents Chuck's willingness to take on financial risks in pursuit of higher returns. Understanding the connection between risk tolerance and "How Much Money Does Chuck" have is essential for making informed investment decisions and achieving financial goals.

Individuals with a high risk tolerance are more likely to invest in assets that have the potential for significant growth, but also carry a higher level of risk. Examples include stocks, venture capital, or real estate investments. Conversely, individuals with a low risk tolerance may prefer to invest in more conservative assets, such as bonds or money market accounts, which offer lower potential returns but also lower risk.

The practical significance of understanding the connection between risk tolerance and "How Much Money Does Chuck" have is evident in investment decisions. By aligning his investment strategy with his risk tolerance, Chuck can increase the likelihood of achieving his financial goals while minimizing the potential for significant losses. For example, a young Chuck with a high risk tolerance may choose to invest a larger portion of his portfolio in stocks, while an older Chuck nearing retirement with a low risk tolerance may prefer to invest more in bonds.

In summary, risk tolerance is a critical component of "How Much Money Does Chuck" have. By understanding his risk tolerance and aligning his investment strategy accordingly, Chuck can make informed decisions that increase his chances of achieving financial success.

Investment Strategy

Investment strategy plays a pivotal role in determining "How Much Money Does Chuck" have. It encompasses the decisions Chuck makes regarding the allocation of his financial resources, with the goal of achieving his financial goals and objectives.

- Asset Allocation

Asset allocation involves dividing Chuck's investment portfolio into different asset classes, such as stocks, bonds, real estate, and cash. The optimal asset allocation for Chuck depends on his risk tolerance, investment horizon, and financial goals.

- Diversification

Diversification is a risk management strategy that involves investing in a variety of assets with different risk and return characteristics. By diversifying his portfolio, Chuck can reduce the overall risk of his investments without sacrificing potential returns.

- Rebalancing

Rebalancing is the process of periodically adjusting the asset allocation of Chuck's portfolio to maintain his desired risk and return profile. As market conditions change, rebalancing helps Chuck ensure that his portfolio remains aligned with his financial goals.

- Tax Optimization

Tax optimization involves making investment decisions that minimize Chuck's tax liability. This can include utilizing tax-advantaged accounts, such as 401(k) plans and IRAs, and choosing investments that are tax-efficient.

By carefully considering each aspect of his investment strategy, Chuck can increase his chances of achieving his financial goals and maximizing "How Much Money Does Chuck" have.

Tax Implications

Tax implications play a significant role in determining "How Much Money Does Chuck" have. Understanding the tax implications associated with income, investments, and financial decisions is essential for Chuck to optimize his financial situation and maximize his wealth. The following are key facets of tax implications that Chuck should consider:

- Taxable Income

Chuck's taxable income is the portion of his income that is subject to taxation. Understanding how different types of income are taxed can help Chuck plan his financial affairs to minimize his tax liability.

- Tax Deductions

Certain expenses and contributions are tax-deductible, which can reduce Chuck's taxable income. Taking advantage of eligible deductions can help Chuck lower his tax bill and increase his after-tax income.

- Tax Credits

Tax credits are direct reductions in the amount of taxes owed. Unlike deductions, which reduce taxable income, tax credits provide a dollar-for-dollar reduction in tax liability.

- Tax-Advantaged Accounts

Investing in tax-advantaged accounts, such as 401(k) plans and IRAs, offers tax benefits that can help Chuck grow his wealth more efficiently. Contributions to these accounts may be tax-deductible or grow tax-free, providing significant long-term savings.

By understanding and considering the tax implications associated with his financial decisions, Chuck can make informed choices that help him optimize "How Much Money Does Chuck" have and achieve his financial goals.

In conclusion, "How Much Money Does Chuck" have is a multifaceted concept that encompasses various aspects of Chuck's financial situation, including income, assets, liabilities, investments, savings, expenses, financial goals, risk tolerance, investment strategy, and tax implications. By understanding these interconnected components, Chuck can make informed financial decisions that help him achieve his financial objectives and accumulate wealth.

Key insights from this exploration include the importance of aligning investment strategy with risk tolerance, leveraging tax-advantaged accounts for long-term savings growth, and regularly reviewing financial goals and adjusting strategies as circumstances change. "How Much Money Does Chuck" have is not merely a static figure but a dynamic reflection of Chuck's financial literacy, planning, and commitment to achieving his financial aspirations.

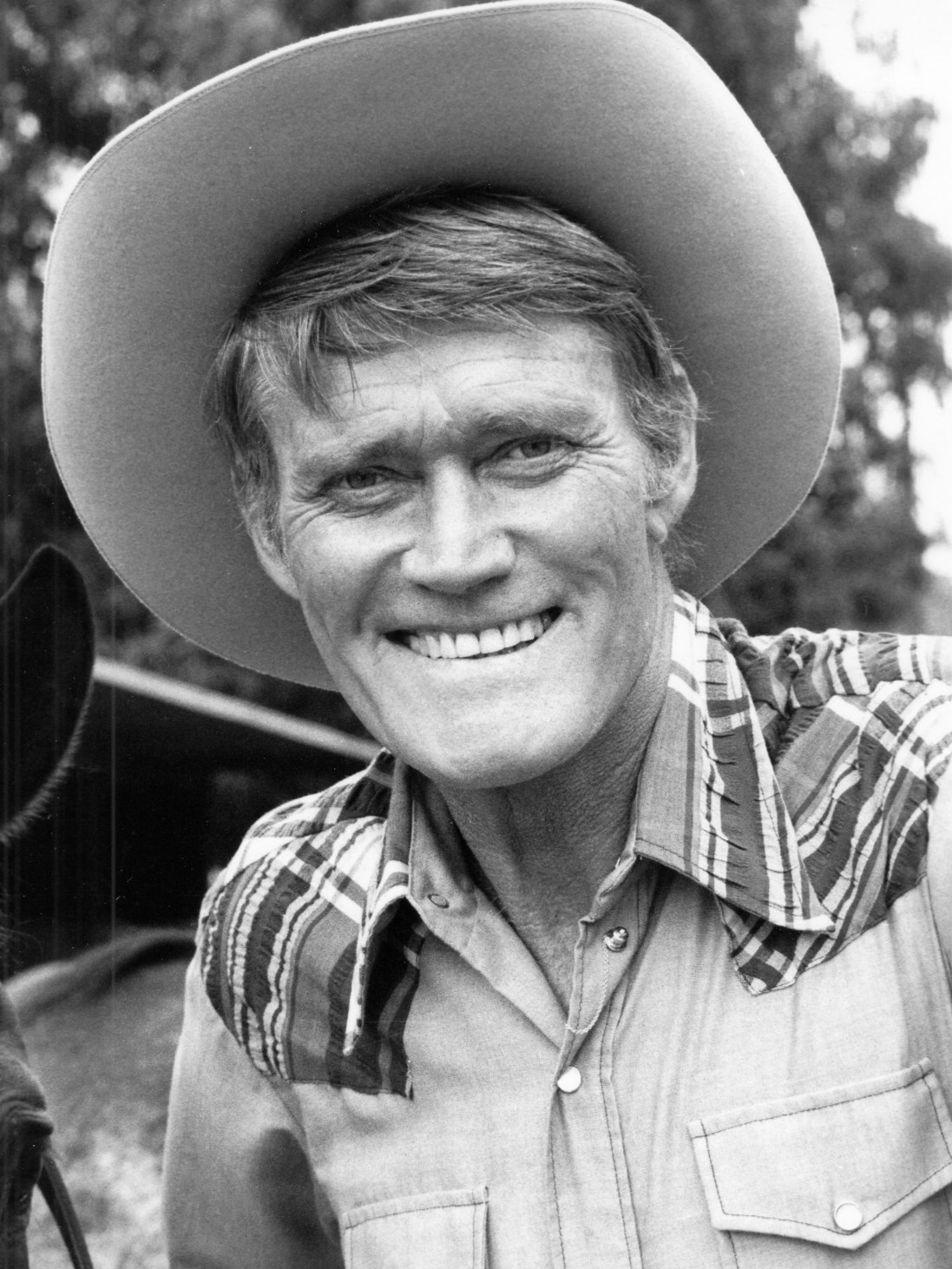

How Much Money Does Chuck Connors Make? Latest Chuck Connors Net Worth

Chuck Todd to Bloomberg Should You Exist? Have You Earned Too Much

How Much Money Does Chuck E Cheese Make?? YouTube