How Much Money Does Russell: A Guide To Understanding Net Worth

How Much Money Does Russell is a financial inquiry that quantifies an individual's wealth, net worth, or income. In practical terms, it involves determining the total value of a person's assets (such as stocks, bonds, real estate, and cash) and subtracting their liabilities (such as debts and mortgages).

Understanding a person's financial position is crucial for making informed decisions about investments, retirement planning, and financial risk management. Historically, the concept of net worth has been used by banks and other lending institutions to assess an individual's creditworthiness.

This article explores the various ways to calculate and interpret "How Much Money Does Russell" and its implications for financial planning and decision-making.

How Much Money Does Russell

Understanding the key aspects of "How Much Money Does Russell" is essential for assessing an individual's financial well-being and making informed financial decisions.

- Assets

- Liabilities

- Net Worth

- Income

- Expenses

- Cash Flow

- Investments

- Financial Goals

- Credit Score

These aspects are interconnected and provide a comprehensive view of an individual's financial situation. By understanding these aspects, individuals can make informed decisions about how to manage their finances, grow their wealth, and achieve their financial goals.

Assets

Assets are the foundation of "How Much Money Does Russell" calculations, representing everything an individual owns that has monetary value. They provide a snapshot of an individual's financial strength and contribute directly to their net worth.

- Cash and Cash Equivalents

This includes physical cash, checking and savings accounts, and money market accounts. These assets are highly liquid and readily accessible.

- Investments

Stocks, bonds, mutual funds, and real estate are common investment assets that can appreciate in value over time, providing potential returns.

- Physical Assets

Tangible assets such as real estate, vehicles, and collectibles can contribute to an individual's net worth, although they may be less liquid than other assets.

- Intellectual Property

Patents, trademarks, and copyrights can also be valuable assets, providing individuals with exclusive rights to their creations or inventions.

Understanding the different types of assets and their implications is crucial for managing wealth effectively. By diversifying their assets across various categories, individuals can spread their risk and potentially enhance their overall financial position.

Liabilities

Liabilities represent the debts and obligations that an individual owes to others. Understanding liabilities is critical for assessing financial health and calculating "How Much Money Does Russell". Liabilities can significantly impact an individual's financial position and ability to achieve their financial goals.

Liabilities are typically classified into two categories: current liabilities and long-term liabilities. Current liabilities are due within one year and include items such as credit card debt, short-term loans, and accounts payable. Long-term liabilities, on the other hand, have maturities of more than one year and include mortgages, car loans, and bonds. Both types of liabilities affect "How Much Money Does Russell" by reducing an individual's net worth.

Managing liabilities effectively is crucial for financial well-being. Individuals should aim to keep their debt levels low relative to their income and assets. High levels of debt can strain an individual's cash flow, limit their borrowing capacity, and hinder their ability to save and invest. Prudent financial planning involves carefully considering the impact of liabilities on "How Much Money Does Russell" and developing strategies to manage debt effectively.

In summary, liabilities play a critical role in determining "How Much Money Does Russell". By understanding the different types of liabilities and their implications, individuals can make informed financial decisions, manage their debt effectively, and achieve their long-term financial goals.

Net Worth

Net worth serves as a cornerstone of "How Much Money Does Russell". It captures the overall financial health of an individual by summarizing their assets and liabilities. Understanding net worth provides valuable insights into an individual's financial well-being and ability to achieve their long-term financial goals.

- Assets

Assets encompass everything an individual owns that has monetary value, including cash, investments, real estate, and intellectual property. Assets contribute directly to an individual's net worth, providing a snapshot of their financial strength.

- Liabilities

Liabilities represent the debts and obligations an individual owes to others, such as mortgages, car loans, and credit card balances. Liabilities reduce an individual's net worth and impact their financial flexibility.

- Income

Income refers to the regular flow of money an individual earns from their job, investments, or other sources. Income is crucial for building wealth and increasing net worth over time.

- Expenses

Expenses represent the costs associated with maintaining a certain lifestyle, including housing, food, transportation, and entertainment. Managing expenses effectively is essential for preserving and growing net worth.

In essence, net worth serves as a comprehensive measure of an individual's financial well-being. By understanding the interplay between assets, liabilities, income, and expenses, individuals can make informed financial decisions, plan for the future, and achieve their financial goals.

Income

Income stands as a pivotal pillar of "How Much Money Does Russell", representing the inflow of funds that contribute to an individual's financial well-being and net worth. It encompasses various streams of earnings that collectively determine an individual's financial capacity and ability to meet their financial obligations.

- Employment Income

This refers to the regular wages, salaries, or commissions earned from an individual's primary occupation. It is the most common and stable form of income for many individuals.

- Investment Income

Income generated from investments in stocks, bonds, or real estate. Dividends, interest payments, and rental income fall under this category.

- Business Income

Income earned from self-employment or business ventures, including profits from sole proprietorships, partnerships, or corporations.

- Passive Income

Income that is earned with minimal effort and without active involvement, such as royalties, rental income from properties, or income from online ventures.

Understanding the different facets of income is crucial for managing personal finances effectively. By diversifying income streams and maximizing earnings potential, individuals can enhance their financial resilience, accumulate wealth, and achieve their long-term financial goals.

Expenses

Expenses are a fundamental aspect of "How Much Money Does Russell", representing the outflow of funds used to maintain a certain lifestyle and fulfill financial obligations. Understanding expenses is crucial for managing personal finances effectively, as they directly impact an individual's financial well-being and ability to accumulate wealth.

- Fixed Expenses

Fixed expenses remain relatively constant from month to month and include essential costs such as rent or mortgage payments, car payments, and insurance premiums.

- Variable Expenses

Variable expenses fluctuate based on individual choices and consumption patterns, such as groceries, entertainment, and transportation costs.

- Discretionary Expenses

Discretionary expenses are non-essential expenditures that can be adjusted or eliminated without significantly impacting an individual's lifestyle, including dining out, travel, and hobbies.

- Debt Repayment

Debt repayment, such as credit card payments and student loan installments, is a crucial expense category that affects an individual's financial health and "How Much Money Does Russell".

Managing expenses effectively involves tracking spending patterns, identifying areas for potential savings, and prioritizing essential expenses over discretionary ones. By understanding the different facets of expenses and their impact on "How Much Money Does Russell", individuals can make informed financial decisions, optimize their cash flow, and achieve their long-term financial goals.

Cash Flow

Cash flow plays a pivotal role in determining "How Much Money Does Russell". It provides insights into the movement of funds into and out of an individual's possession, offering a dynamic perspective on their financial health and overall financial well-being. Understanding the intricacies of cash flow is essential for informed financial decision-making and achieving long-term financial goals.

- Operating Cash Flow

The flow of funds generated from a business's core operations, including revenue, expenses, and changes in working capital.

- Investing Cash Flow

The flow of funds used to acquire or dispose of long-term assets, such as property, plant, or equipment.

- Financing Cash Flow

The flow of funds obtained from external sources, such as loans or issuing stock, and used to finance operations or investments.

- Free Cash Flow

The cash flow available to a company after accounting for operating expenses, capital expenditures, and other financing activities. It represents the true cash-generating capacity of a business.

Analyzing cash flow provides valuable insights into a company's financial performance, stability, and ability to generate value for its stakeholders. It is a crucial metric for assessing a company's liquidity, solvency, and overall financial health.

Investments

Investments play a critical role in determining "How Much Money Does Russell". They represent the allocation of funds with the expectation of generating positive returns over time. Understanding the relationship between investments and "How Much Money Does Russell" is essential for making informed financial decisions and achieving long-term financial goals.

Investments can significantly increase an individual's net worth and overall financial well-being. By investing in assets such as stocks, bonds, and real estate, individuals can potentially earn returns that outpace inflation and grow their wealth. Investments can also provide a source of passive income, such as dividends or rental income, which can further contribute to "How Much Money Does Russell".

Real-life examples of investments within "How Much Money Does Russell" include investing in retirement accounts, such as 401(k)s or IRAs, contributing to employee stock purchase plans, or investing in a diversified portfolio of stocks and bonds. These investments can help individuals accumulate wealth over time, reduce their tax burden, and secure their financial future.

Understanding the practical applications of the connection between investments and "How Much Money Does Russell" is crucial for effective financial planning. Individuals should consider their investment goals, risk tolerance, and time horizon when making investment decisions. By aligning their investments with their financial objectives, individuals can maximize their potential for financial success and achieve their long-term financial goals.

Financial Goals

Financial goals are a personal roadmap for achieving your long-term financial aspirations. By establishing a clear and achievable set of goals, you can lay the foundation for financial success and ensure your "How Much Money Does Russell" is moving in the right direction.

Financial goals are a critical component of "How Much Money Does Russell". They provide a sense of purpose and direction for your financial decisions, helping you prioritize your spending, saving, and investment strategies. Without well-defined financial goals, it can be challenging to stay motivated and make effective use of your financial resources.

Real-life examples of financial goals within "How Much Money Does Russell" include saving for retirement, purchasing a home, funding your children's education, or starting your own business. These goals require careful planning and a disciplined approach to financial management, as they often involve long-term savings and investment strategies.

Understanding the practical applications of the connection between financial goals and "How Much Money Does Russell" is crucial for effective financial planning. By aligning your financial goals with your "How Much Money Does Russell", you can make informed decisions about how to allocate your financial resources, manage your expenses, and maximize your potential for financial success. Remember, financial goals are not static; they should be reviewed and adjusted regularly to ensure they remain aligned with your evolving needs and circumstances.

Credit Score

In the realm of "How Much Money Does Russell", one cannot overlook the profound impact of "Credit Score". It serves as a beacon of an individual's financial trustworthiness, opening doors to a world of opportunities and shaping their overall financial well-being.

- Payment History

The linchpin of a credit score, it measures the consistency and timeliness of past debt repayments, reflecting an individual's reliability in honoring financial obligations.

- Amounts Owed

Lenders assess the extent to which an individual's current debts burden their financial capacity, evaluating the ratio of debt to available credit and the total amount owed.

- Length of Credit History

A seasoned credit history, characterized by long-standing accounts and a consistent track record, instills confidence in lenders, indicating a borrower's experience in managing credit responsibly.

- New Credit

In essence, a strong credit score signifies financial responsibility and trustworthiness, making it easier to secure loans, qualify for favorable interest rates, and access a wide range of financial products and services. Conversely, a low credit score can limit financial opportunities, result in higher borrowing costs, and hinder an individual's ability to achieve their "How Much Money Does Russell" goals.

In exploring "How Much Money Does Russell", we have delved into the intricate tapestry of financial well-being, encompassing assets, liabilities, income, expenses, and investments. Understanding these elements and their interplay is crucial for navigating the financial landscape and achieving long-term financial goals.

Key points to remember include the importance of managing debt effectively, the power of compounding interest in investments, and the role of financial planning in aligning resources with aspirations. Each of these aspects is interconnected, forming a holistic view of financial health. By embracing prudent financial habits, individuals can unlock their full financial potential and secure a brighter financial future.

How Much Money Does Jesse Russell Make? Latest Jesse Russell Net Worth

How Much Money Does Russell Brand Have? New Update

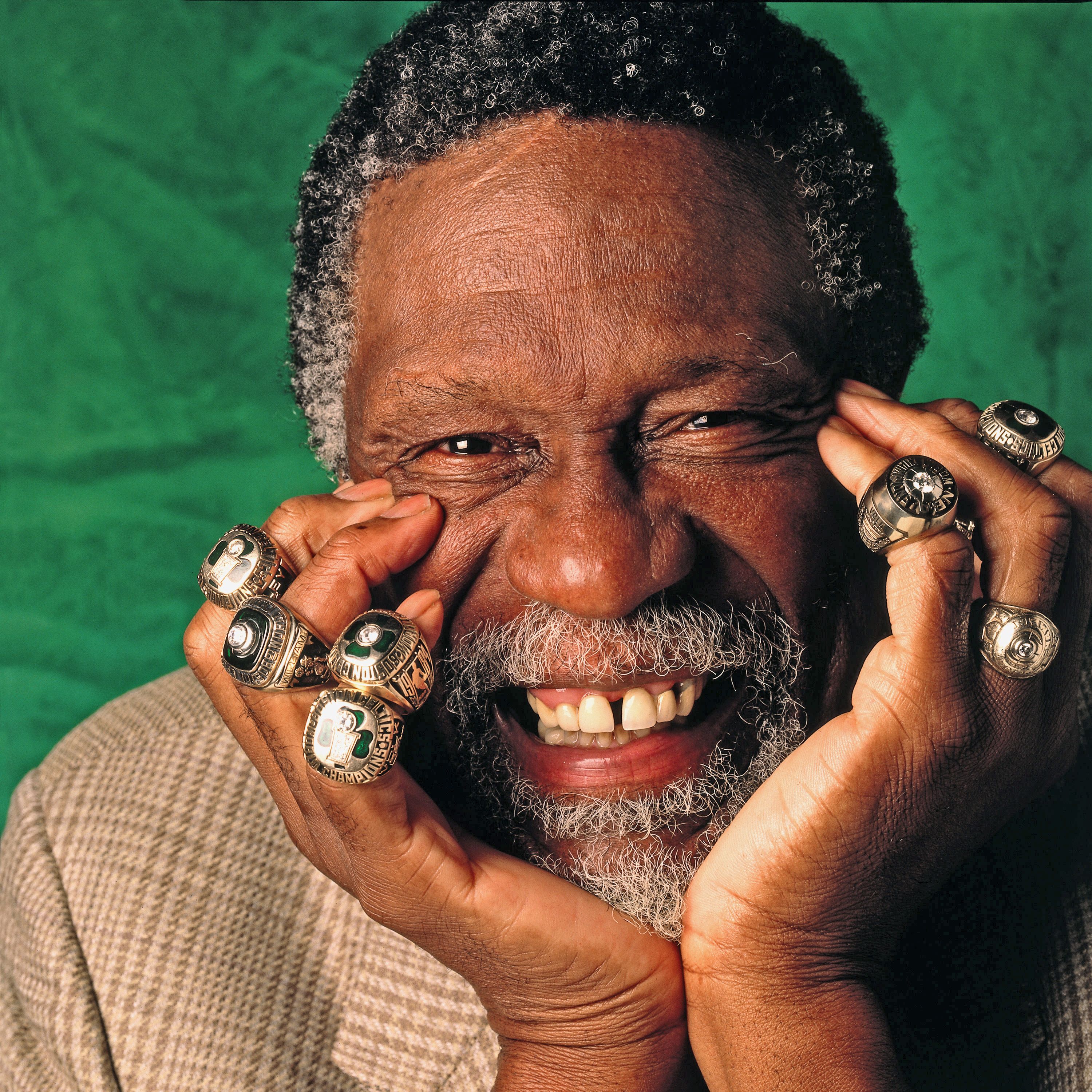

Remembering NBA legend and civil rights icon Bill Russell