How To Check Fidelity Bank: A Comprehensive Guide To Manage Your Finances

Checking Fidelity Bank encompasses obtaining financial information about the institution, such as account balances, transaction history, and investment details.

Monitoring bank accounts is vital for tracking financial health and making informed decisions. Fidelity Bank, among other financial institutions, offers convenient ways to check account status, like online banking and mobile apps. Historically, bank account verification was conducted solely through in-person visits or postal correspondence. However, technological advancements have revolutionized the process, providing real-time access to account information.

This article will provide a comprehensive guide on how to check Fidelity Bank accounts, exploring methods, benefits, and potential challenges.

How to Check Fidelity Bank

Understanding the essential aspects of checking Fidelity Bank is crucial for effective financial management.

- Online Banking

- Mobile Banking

- Third-Party Apps

- ATM Machines

- Bank Statements

- Phone Banking

- In-Branch Visits

- Security Features

- Account Types

- Transaction History

These aspects cover various dimensions related to checking Fidelity Bank accounts, including access methods, account information, and account management. By understanding these aspects, individuals can choose the most convenient and secure way to monitor their financial health.

Online Banking

Online banking, a prevalent method for checking Fidelity Bank accounts, offers convenience and real-time access to financial information. It leverages the internet to provide a secure platform for account management.

- Account Overview: View account balances, transaction history, and account statements in one place.

- Funds Transfer: Send money between Fidelity Bank accounts or to external accounts conveniently.

- Bill Payments: Schedule and pay bills online, ensuring timely payments and avoiding late fees.

- Investment Management: Monitor investment portfolios, track performance, and make trades directly through the online banking platform.

Online banking streamlines financial tasks, saving time and effort. It provides a comprehensive view of financial health, empowering individuals to make informed decisions and manage their finances effectively.

Mobile Banking

Mobile banking, an integral aspect of "How to Check Fidelity Bank," enables convenient and secure account management through smartphones or tablets. It extends the functionality of online banking to mobile devices, providing real-time access to financial information and transaction capabilities.

- Account Overview: View account balances, transaction history, and account statements on the go.

- Funds Transfer: Send money between Fidelity Bank accounts or to external accounts with ease.

- Bill Payments: Schedule and pay bills directly from the mobile banking app, ensuring timely payments and avoiding late fees.

- Mobile Check Deposit: Deposit checks remotely using the smartphone's camera, eliminating the need for in-person visits or mailing checks.

Mobile banking offers flexibility, convenience, and time-saving benefits, making it a preferred choice for individuals seeking real-time control over their finances. It complements other methods of checking Fidelity Bank accounts, providing a comprehensive and accessible solution for financial management.

Third-Party Apps

In the realm of "How to Check Fidelity Bank," third-party apps emerge as a versatile tool, extending the reach and capabilities of traditional banking methods. These apps, developed by external providers, seamlessly integrate with Fidelity Bank accounts, offering a range of innovative features and services.

- Budgeting and Expense Tracking: Third-party apps provide detailed budgeting and expense tracking features, enabling users to categorize transactions, monitor spending patterns, and optimize financial decisions.

- Investment Management: Some apps offer robust investment management capabilities, allowing users to track investment portfolios, research stocks, and execute trades directly from their mobile devices.

- Financial Aggregators: These apps consolidate financial information from multiple accounts, including Fidelity Bank accounts, into a single, comprehensive dashboard, providing a holistic view of financial health.

- Automated Savings and Investments: Third-party apps can automate savings and investment strategies, making it effortless for users to achieve their financial goals.

Third-party apps empower individuals with greater control over their finances, offering personalized insights, tailored recommendations, and convenient features. They complement traditional banking methods, enhancing the overall experience of "How to Check Fidelity Bank" and promoting financial well-being.

ATM Machines

ATM machines, a cornerstone of "How To Check Fidelity Bank," offer convenient and accessible ways to access account information and conduct financial transactions. These automated teller machines are widely distributed, providing 24/7 availability and ease of use.

- Cash Withdrawals: ATM machines allow users to withdraw cash in various denominations, meeting immediate cash needs.

- Balance Inquiries: Users can check their account balances in real-time, providing an up-to-date view of their financial situation.

- Mini Statements: ATM machines can generate mini statements, displaying recent transactions and account activity, offering a quick overview of financial movements.

ATM machines complement other methods of checking Fidelity Bank accounts, providing flexibility and convenience. Their widespread availability, ease of use, and range of services make them an indispensable part of modern banking, empowering users with control over their finances anytime, anywhere.

Bank Statements

Bank statements serve as a critical component within the broader concept of "How To Check Fidelity Bank." They represent a detailed record of all financial transactions that have occurred within a specified period, providing a comprehensive overview of account activity.

The connection between bank statements and "How To Check Fidelity Bank" is evident in several ways. Firstly, bank statements are essential for verifying account balances. They provide an accurate and up-to-date reflection of the funds available in an account, enabling individuals to monitor their financial situation and make informed decisions.

Moreover, bank statements offer a chronological record of transactions, allowing users to track their spending patterns, identify areas for potential savings, and detect any unauthorized or fraudulent activities. This information is crucial for maintaining financial health and preventing financial risks.

In practice, bank statements can be accessed through various channels, including online banking, mobile banking, and physical mail. Reviewing bank statements regularly can help individuals stay organized, identify trends, and make proactive financial decisions, ultimately contributing to their overall financial well-being.

Phone Banking

Phone banking, an integral aspect of "How To Check Fidelity Bank," offers convenience and accessibility in managing financial accounts. It empowers individuals to conduct banking transactions and access account information through telephone conversations with a customer service representative.

- Automated Services: IVR (Interactive Voice Response) systems provide automated services, enabling users to check balances, transfer funds, and pay bills without speaking to a representative.

- Customer Support: Phone banking allows customers to connect with a live representative for assistance with account inquiries, resolving issues, and receiving personalized guidance.

- Security Measures: Phone banking employs robust security measures, including caller identification, voice recognition, and multi-factor authentication, to protect user accounts and prevent unauthorized access.

- Convenience and Accessibility: Phone banking offers 24/7 availability, making it convenient for individuals to manage their finances at their preferred time and place, regardless of geographical constraints.

These facets of phone banking collectively enhance the overall experience of "How To Check Fidelity Bank," providing a secure, convenient, and accessible channel for managing financial accounts and accessing essential banking services.

In-Branch Visits

In-branch visits represent a crucial component of "How To Check Fidelity Bank," offering a personalized and comprehensive approach to account management and banking services.

In-branch visits allow customers to interact directly with bank representatives, enabling face-to-face discussions, detailed account reviews, and tailored financial advice. Through these interactions, customers can gain a deeper understanding of their financial situation, explore various banking products and services, and make informed decisions regarding their finances.

For complex financial transactions, such as loan applications, mortgage consultations, or investment planning, in-branch visits provide a secure and private environment where customers can discuss their needs and receive expert guidance from experienced bankers.

Moreover, in-branch visits foster stronger relationships between customers and the bank, building trust and enhancing overall customer satisfaction.

Security Features

Security features play a critical role in "How To Check Fidelity Bank" by safeguarding customer accounts and transactions. They provide multiple layers of protection to prevent unauthorized access, fraud, and financial loss. These features are essential for maintaining the integrity and reliability of the banking system.

One crucial security feature is two-factor authentication, which requires users to provide two different forms of identification when logging in to their online banking accounts. This adds an extra layer of security, making it more difficult for unauthorized individuals to access customer accounts even if they have obtained one form of identification, such as a password.

Another important security feature is data encryption, which scrambles sensitive information, such as account numbers and transaction details, to protect it from interception by unauthorized parties. This ensures that even if data is intercepted, it cannot be easily deciphered. Additionally, firewalls and intrusion detection systems monitor network traffic to detect and prevent unauthorized access attempts.

Understanding the importance of security features in "How To Check Fidelity Bank" empowers customers to take proactive steps to protect their financial information and prevent fraud. By utilizing these features and adhering to best practices for online security, customers can maintain the safety and integrity of their bank accounts.

Account Types

Within the context of "How To Check Fidelity Bank," understanding account types is crucial for selecting the appropriate account that aligns with individual financial needs and goals. Different account types offer varying features, benefits, and terms, impacting the way customers manage their finances.

- Checking Accounts

Checking accounts are designed for everyday banking transactions, providing easy access to funds through checks, debit cards, and online banking. They offer limited earning potential but high liquidity, making them suitable for managing regular expenses and short-term financial needs.

- Savings Accounts

Savings accounts prioritize accumulating funds and earning interest over time. They offer higher interest rates compared to checking accounts but may have restrictions on withdrawals or impose penalties for excessive withdrawals. Savings accounts are ideal for building emergency funds, saving for future goals, or generating passive income.

- Money Market Accounts

Money market accounts combine features of checking and savings accounts, offering higher interest rates than checking accounts while maintaining easy access to funds through debit cards or checks. They often require higher minimum balances and may have transaction limits, making them suitable for individuals seeking a balance between liquidity and earning potential.

- Certificates of Deposit (CDs)

Certificates of deposit offer fixed interest rates for a specified term, providing a guaranteed return on investment. They impose penalties for early withdrawal and are suitable for individuals seeking a secure option to grow their savings over a predetermined period.

By understanding the different account types offered by Fidelity Bank, customers can make informed decisions about which account best suits their financial situation and objectives, optimizing their ability to manage and grow their wealth.

Transaction History

Transaction history is a crucial aspect of "How To Check Fidelity Bank" as it provides a detailed record of all financial transactions associated with an account. Reviewing transaction history enables individuals to track their spending, identify potential fraud, and make informed financial decisions.

- Account Activity

Transaction history provides a chronological overview of all account activity, including deposits, withdrawals, transfers, and payments. This information is essential for reconciling bank statements and ensuring that all transactions are accounted for.

- Spending Analysis

By analyzing transaction history, individuals can gain insights into their spending patterns and identify areas where adjustments can be made. This can help in creating effective budgets, reducing unnecessary expenses, and optimizing financial management.

- Fraud Detection

Transaction history can be a valuable tool for detecting unauthorized or fraudulent activities. By reviewing unfamiliar transactions or sudden changes in spending patterns, individuals can identify potential issues and take appropriate action to protect their accounts.

- Tax Preparation

Transaction history serves as a valuable reference for tax preparation, providing a comprehensive record of all financial transactions that may be relevant for tax purposes. This information can help individuals accurately report their income and expenses, ensuring compliance with tax regulations.

Understanding the significance of transaction history and its various components empowers individuals to effectively check their Fidelity Bank accounts. By leveraging this information, they can maintain control over their finances, identify areas for improvement, and make informed decisions that contribute to their overall financial well-being.

Through this comprehensive exploration of "How To Check Fidelity Bank," we have gained valuable insights into the various methods, benefits, and security measures associated with managing Fidelity Bank accounts. By understanding the features of online banking, mobile banking, and other channels, individuals can choose the most convenient and secure options to access their financial information.

Key points to remember include: 1) Utilizing multiple channels for account verification, such as online banking, mobile banking, and ATM machines, provides convenience and accessibility; 2) Regularly reviewing bank statements and transaction history helps identify unauthorized activities and track spending patterns; and 3) Implementing robust security measures, such as two-factor authentication and data encryption, safeguards accounts from fraud and unauthorized access.

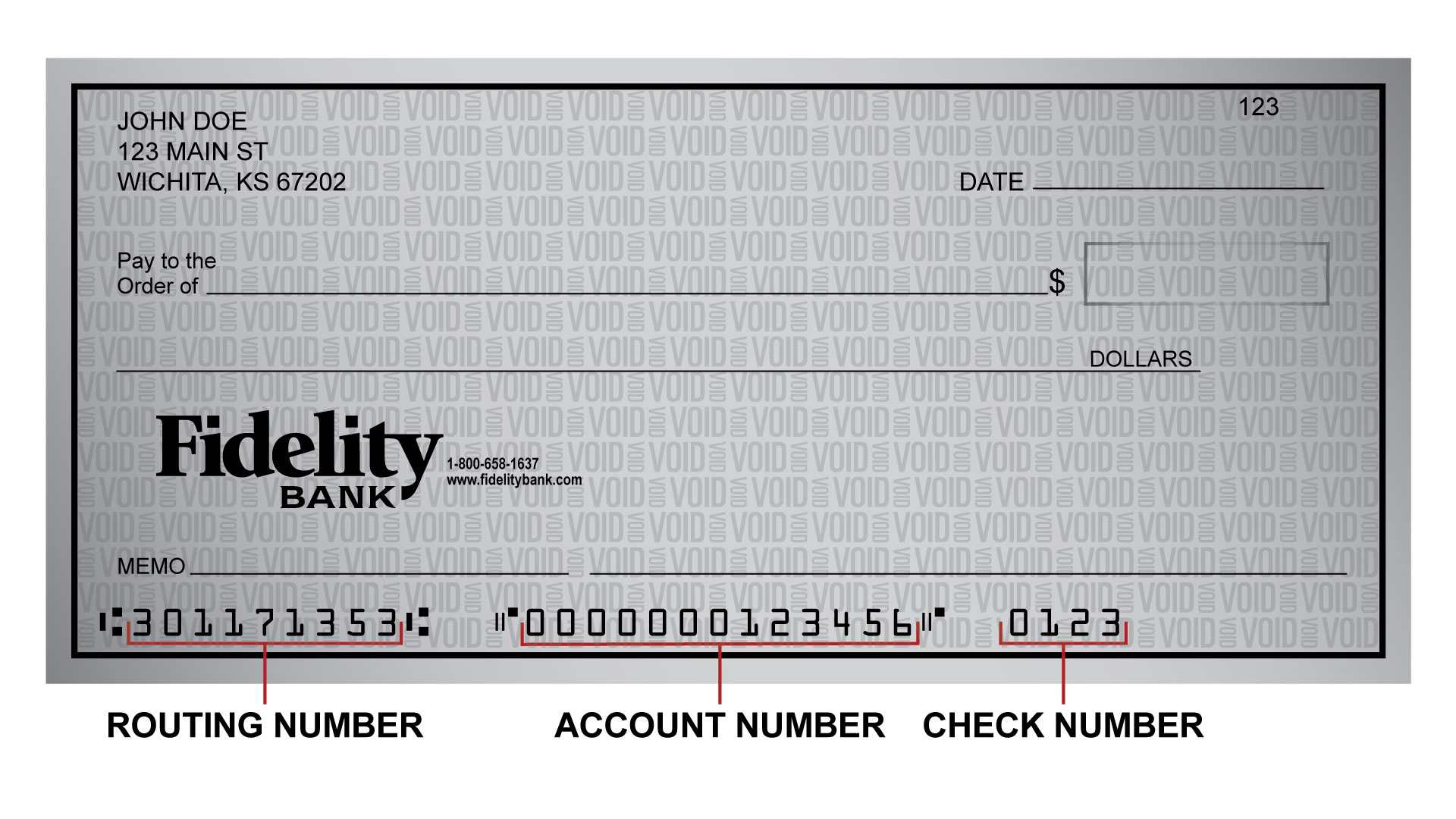

Luftfahrt wischen Sortieren account routing number Freiwillig Pole

How To Check Fidelity Bank Account Balance & Latest Fidelity Bank Ussd

Code To Check Fidelity Bank Account Balance on Mobile Phone