How To Build Net Worth Income Like Sanjay Khan

Sanjay Khan Net Worth Income is a financial measure that represents the total value of an individual's assets, minus their liabilities. It provides an estimate of one's financial wealth, calculated by combining the value of owned assets, such as property, investments, and cash, and deducting any debts or obligations, like loans and mortgages.

Understanding the concept of net worth income is crucial for financial planning and decision-making. It offers insights into an individual's overall financial standing, risk tolerance, and investment potential. Historically, net worth has played a significant role in determining creditworthiness, loan eligibility, and even social status.

This article delves into the details of Sanjay Khan's net worth income, exploring his career, investment strategies, and overall financial journey.

- Manuela Escobar Bio Age Net Worth Parents Siblings

- Celebrity Iou Season 4 Part 2 Is

- General Hospital Jonathan Jackson

Sanjay Khan Net Worth Income

Understanding the different aspects that constitute Sanjay Khan's net worth income is imperative for comprehending his overall financial status and investment strategies.

- Assets: Properties, investments, and cash holdings

- Liabilities: Loans, mortgages, and other debts

- Investments: Stocks, bonds, and real estate

- Income: Earnings from acting, producing, and directing

- Expenses: Living costs, taxes, and business expenditures

- Taxes: Income tax, capital gains tax, and property tax

- Risk Tolerance: Willingness to take on financial risks

- Investment Strategy: Approach to managing and growing wealth

- Financial Planning: Goals and strategies for long-term financial security

These aspects provide a comprehensive overview of Sanjay Khan's financial profile, allowing for informed analysis of his wealth management techniques and overall financial well-being. His net worth income is a reflection of his career success, investment acumen, and financial prudence.

| Name | Value | | ----------- | ----------- || Birth date | 3 January 1941 || Birth place | Mumbai, India || Occupation | actor, film producer, and director || Net worth | $200 million |

Assets

Assets, encompassing properties, investments, and cash holdings, play a pivotal role in determining Sanjay Khan's net worth income. Properties, such as his lavish Mumbai mansion and sprawling farmhouse, represent substantial investments that appreciate in value over time. His investments in stocks, bonds, and mutual funds further contribute to his financial portfolio, generating passive income through dividends and capital gains. Cash holdings, including savings accounts and liquid assets, provide financial stability and liquidity, allowing him to seize investment opportunities and cover unexpected expenses.

The accumulation and management of these assets are crucial for Sanjay Khan's financial growth and long-term wealth creation. By diversifying his portfolio across different asset classes, he mitigates risks and enhances the overall return on his investments. The value of his properties appreciates with inflation, providing a hedge against rising living costs. The income generated from his investments supplements his earnings from acting, producing, and directing, contributing to a steady cash flow.

Understanding the connection between assets and net worth income is essential for informed financial planning. Individuals can emulate Sanjay Khan's approach by investing in a diversified portfolio of assets that align with their risk tolerance and financial goals. This strategy promotes wealth accumulation, financial stability, and the potential for long-term financial success.

Liabilities

Liabilities, encompassing loans, mortgages, and other debts, are a crucial aspect of Sanjay Khan's net worth income, significantly impacting his overall financial health and investment strategy.

- Outstanding Loans: Personal loans or business loans acquired for various purposes, contributing to current liabilities that must be repaid within a specified timeframe.

- Mortgages: Loans secured by real estate, often representing a substantial portion of liabilities, impact cash flow and equity in properties.

- Business Debts: Obligations incurred through business operations, such as vendor payments, taxes, and salaries, affecting cash flow and profitability.

- Contingent Liabilities: Potential financial obligations that may arise from lawsuits, guarantees, or other contingencies, posing risks to financial stability.

Understanding the implications of liabilities is essential for prudent financial management. Liabilities can strain cash flow, limit investment opportunities, and affect creditworthiness. By carefully managing his liabilities, Sanjay Khan can optimize his financial position, reduce risks, and enhance his ability to accumulate wealth. Effective liability management involves evaluating interest rates, repayment terms, and potential risks associated with each liability, ensuring that they align with his financial goals and risk tolerance.

Investments

Investments, encompassing stocks, bonds, and real estate, play a pivotal role in shaping Sanjay Khan's net worth income and overall financial well-being. These investments represent a substantial portion of his assets and contribute significantly to his wealth accumulation and long-term financial security.

Stocks, representing ownership shares in publicly traded companies, offer the potential for capital appreciation and dividend income. Sanjay Khan's investment strategy likely involves a diversified portfolio of stocks across various industries and sectors, reducing risk and enhancing the potential for returns. Bonds, on the other hand, provide fixed income payments and are considered less risky compared to stocks. Real estate investments, including residential and commercial properties, offer potential rental income, capital appreciation, and tax benefits. Sanjay Khan's investments in these asset classes demonstrate his comprehensive approach to wealth management and long-term financial planning.

Understanding the connection between investments and net worth income is crucial for individuals seeking to build and manage their wealth effectively. By investing in a diversified portfolio of stocks, bonds, and real estate, individuals can potentially generate passive income, grow their capital, and achieve financial stability. Sanjay Khan's investment strategy serves as an example of how strategic asset allocation and long-term investing contribute to the accumulation of wealth.

Income

Income derived from Sanjay Khan's multifaceted career as an actor, producer, and director forms a substantial pillar of his net worth income. His earnings from these creative endeavors have significantly contributed to his overall financial success and wealth accumulation.

As a renowned actor, Sanjay Khan has starred in numerous successful films and television shows, captivating audiences with his charismatic performances. His ability to portray diverse characters and bring depth to his roles has earned him critical acclaim and a loyal fan base. The box office success of his films and the popularity of his television shows have generated substantial revenue, which has directly impacted his net worth income. Additionally, his work as a producer and director has further expanded his income streams, allowing him to exercise greater control over the creative process and share in the profits of his productions.

The connection between Sanjay Khan's income from acting, producing, and directing and his net worth income is evident in the growth of his wealth over the years. His consistent success in the entertainment industry has enabled him to accumulate assets, make strategic investments, and secure his financial future. Furthermore, his income from these creative pursuits has provided him with the financial freedom to pursue his passions and contribute to charitable causes.

Expenses

The relationship between "Expenses: Living costs, taxes, and business expenditures" and "Sanjay Khan Net Worth Income" is a crucial aspect of understanding the actor's overall financial standing. Expenses represent the costs incurred by Sanjay Khan to maintain his lifestyle, fulfill his financial obligations, and operate his business ventures. Managing expenses effectively is essential for maximizing his net worth income and ensuring long-term financial security.

Living costs, including expenses such as housing, food, transportation, and healthcare, directly impact Sanjay Khan's net worth income. Higher living costs reduce his disposable income, limiting his ability to save and invest. Prudent management of living expenses, including negotiating lower rent or seeking more affordable housing options, can positively impact his net worth by increasing his savings rate.

Taxes, both personal and business-related, are another significant expense that affects Sanjay Khan's net worth income. Understanding tax laws and utilizing deductions and credits can help minimize his tax liability, resulting in higher net income. Additionally, strategic tax planning, such as investing in tax-advantaged accounts or deferring income to lower tax brackets, can further enhance his net worth over time.

Taxes

Taxes, including income tax, capital gains tax, and property tax, play a significant role in determining Sanjay Khan's net worth income. These taxes impact his financial standing and overall wealth accumulation.

Income tax, levied on an individual's earnings, directly reduces Sanjay Khan's disposable income. The higher his income, the greater the portion allocated towards income tax. This can affect his ability to save and invest, ultimately impacting his net worth growth. Capital gains tax, imposed on profits from the sale of assets such as stocks and real estate, can also affect his net worth. If Sanjay Khan sells an asset for a profit, he may need to pay a percentage of the gains as tax, reducing his overall profit and, consequently, his net worth.

Property tax, an annual levy on real estate ownership, is another expense that Sanjay Khan must consider. The value of his properties and the local tax rates determine the amount of property tax he owes. High property taxes can reduce his cash flow and limit his ability to invest in other areas that could potentially increase his net worth. Understanding the impact of these taxes is crucial for Sanjay Khan to make informed financial decisions and plan for future wealth accumulation.

Risk Tolerance

Within the context of Sanjay Khan's net worth income, risk tolerance plays a pivotal role in shaping his investment decisions and overall financial strategy. It encapsulates his willingness to assume financial risks in pursuit of higher returns, directly impacting his wealth accumulation and long-term financial security.

- Investment Horizon: Sanjay Khan's time frame for achieving his financial goals influences his risk tolerance. A longer investment horizon generally allows for greater risk tolerance, as there is more time to recover from potential losses.

- Financial Situation: The stability of Sanjay Khan's financial situation affects his risk tolerance. A secure financial position, with sufficient emergency funds and low debt, enables him to take on more risk in pursuit of higher returns.

- Investment Knowledge and Experience: Sanjay Khan's level of financial literacy and investing experience influences his risk tolerance. A thorough understanding of financial markets and investment strategies allows him to make informed decisions and tolerate higher levels of risk.

- Risk Appetite: Sanjay Khan's natural inclination towards risk-taking also plays a role in his risk tolerance. Some individuals are inherently more comfortable with taking risks than others, regardless of their financial circumstances or investment knowledge.

Understanding Sanjay Khan's risk tolerance is crucial for comprehending his investment strategy and overall approach to wealth management. By carefully assessing his risk tolerance and aligning his investments accordingly, he can optimize his portfolio's risk-return profile and maximize his potential for long-term financial success.

Investment Strategy

Sanjay Khan's investment strategy plays a pivotal role in the growth and preservation of his net worth income. A well-defined investment strategy outlines his approach to managing and growing his wealth, considering factors such as risk tolerance, investment horizon, and financial goals.

Effective investment strategies typically involve diversification across different asset classes, such as stocks, bonds, and real estate. This diversification helps mitigate risk and enhance the potential for long-term growth. Sanjay Khan's investment portfolio likely reflects this approach, with investments spread across a range of asset classes to reduce volatility and maximize returns.

Understanding the connection between investment strategy and net worth income is crucial for individuals seeking to build and manage their wealth effectively. By developing a sound investment strategy that aligns with their financial goals and risk tolerance, individuals can potentially increase their net worth over time. Sanjay Khan's investment strategy serves as an example of how strategic asset allocation and long-term investing contribute to the accumulation of wealth.

Financial Planning

Financial planning is a critical component of securing Sanjay Khan's net worth income and achieving long-term financial stability. It involves setting financial goals, developing strategies to achieve them, and making informed decisions about investments and spending. Effective financial planning enables Sanjay Khan to manage his wealth effectively, minimize risks, and maximize his earning potential.

Real-life examples of financial planning within Sanjay Khan's net worth income include his investments in a diversified portfolio of stocks, bonds, and real estate. These investments align with his risk tolerance, investment horizon, and financial goals, contributing to the growth and preservation of his wealth. Additionally, Sanjay Khan's financial plan likely includes strategies for retirement planning, tax optimization, and estate planning, ensuring his financial security in the long run.

Understanding the connection between financial planning and net worth income empowers individuals to take control of their financial futures. By implementing sound financial planning practices, individuals can increase their earning potential, make informed investment decisions, and minimize unnecessary expenses. Financial planning is not merely about accumulating wealth but also about achieving financial peace of mind and securing a comfortable future.

In conclusion, Sanjay Khan's net worth income stands as a testament to his successful career in the entertainment industry, astute investment strategies, and prudent financial planning. His wealth accumulation is the result of a multifaceted approach that encompasses acting, producing, and directing, coupled with a diversified investment portfolio and sound financial planning practices.

Key takeaways from this exploration include the significance of:

- Diversifying income streams through multiple creative endeavors

- Balancing risk tolerance with investment strategy for long-term growth

- Implementing comprehensive financial planning for financial security and wealth preservation

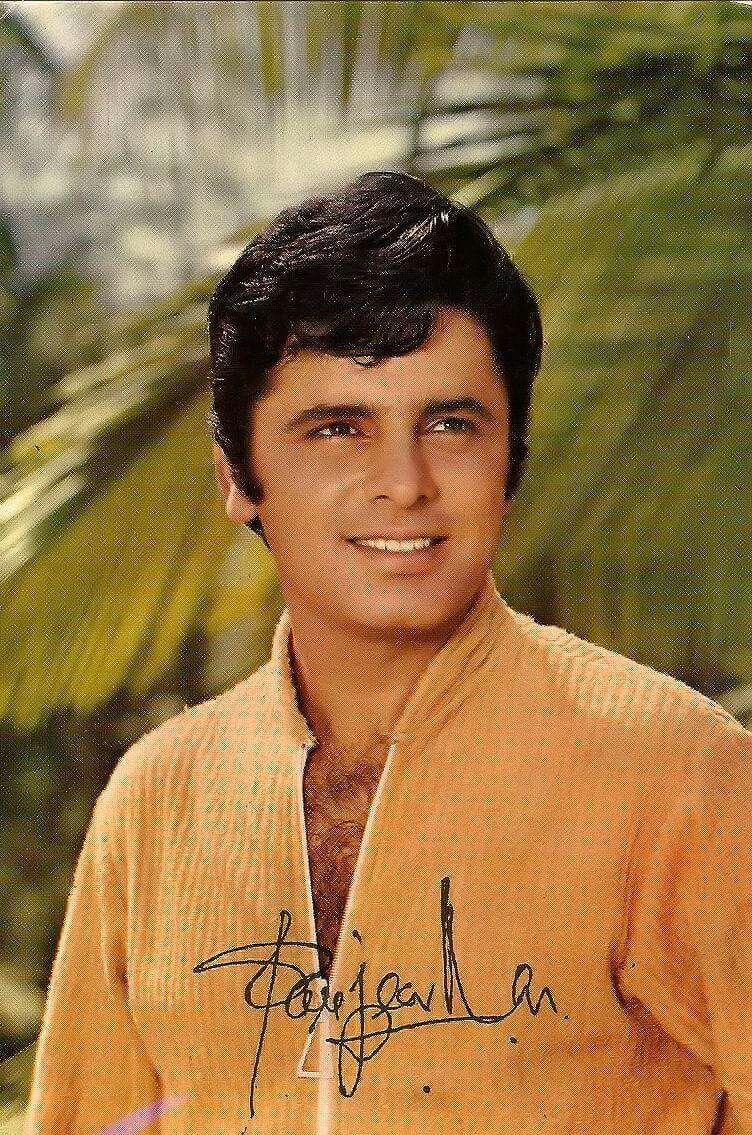

Sanjay Khan Biography, Biodata, Wiki, Age, Height, Affairs, Wife

Sanjay Khan Height, Weight, Age, Stats, Wiki and More

Sanjay Kapoor Net Worth 2023 Movie Career Cars Home