Who's The CEO Of Altimeter Capital? Meet Brad Gerstner

"Who Is Altimeter Capital Ceo" refers to the individual who holds the chief executive officer position at Altimeter Capital, a renowned private equity firm. For instance, Brad Gerstner has been the CEO of Altimeter Capital since its inception.

Identifying the Altimeter Capital CEO is crucial for understanding the leadership and strategic direction of the firm. CEOs play a pivotal role in shaping the company's investment decisions, driving innovation, and ensuring financial success. A notable development in the history of Altimeter Capital was its launch in 2009 amidst the global financial crisis.

This article delves into the background, qualifications, and key responsibilities of Altimeter Capital's CEO, examining their impact on the firm's investment portfolio and overall performance.

Who Is Altimeter Capital Ceo

Understanding the essential aspects of "Who Is Altimeter Capital Ceo" provides insights into the leadership, decision-making, and overall performance of the firm.

- Name: Brad Gerstner

- Title: Chief Executive Officer

- Experience: Investment banking, private equity

- Education: Harvard Business School, Stanford University

- Investment Philosophy: Long-term, value-oriented investing

- Notable Investments: Airbnb, Uber, Snowflake

- Leadership Style: Collaborative, data-driven

- Industry Recognition: Top-ranked CEO in the technology sector

These aspects highlight the CEO's background, expertise, investment approach, and impact on Altimeter Capital's success. His leadership has been instrumental in identifying and investing in disruptive technology companies that have generated significant returns for investors.

Name

Brad Gerstner is the central figure in the exploration of "Who Is Altimeter Capital Ceo." This section dives into the various facets of Gerstner's role, providing a comprehensive understanding of his leadership and impact on Altimeter Capital.

- Founder and CEO: Gerstner is the founder and has served as the CEO of Altimeter Capital since its inception in 2009.

- Investment Expertise: Gerstner brings extensive investment experience, having worked in investment banking and private equity prior to founding Altimeter Capital.

- Technology Focus: Gerstner is known for his focus on investing in disruptive technology companies, leveraging his deep understanding of the sector.

- Collaborative Leadership: Gerstner fosters a collaborative work environment at Altimeter Capital, encouraging teamwork and knowledge sharing.

These facets paint a picture of Brad Gerstner as a visionary leader, skilled investor, and effective CEO. His expertise, investment philosophy, and leadership style have been instrumental in shaping Altimeter Capital's success and establishing Gerstner as a respected figure in the technology investment industry.

Title

The title "Chief Executive Officer" holds a pivotal connection to the concept of "Who Is Altimeter Capital Ceo." The CEO is the central figure responsible for leading and managing the operations of Altimeter Capital, shaping its strategic direction and overall performance.

Brad Gerstner, the founder and current CEO of Altimeter Capital, exemplifies this relationship. Gerstner's expertise in investment banking and private equity, coupled with his deep understanding of the technology sector, has been instrumental in driving Altimeter Capital's success. He has led the firm to make notable investments in disruptive technology companies, generating significant returns for investors.

The CEO's role extends beyond investment decisions. They are responsible for building a strong leadership team, fostering a collaborative work environment, and ensuring the firm's financial health. Gerstner's collaborative leadership style and focus on data-driven decision-making have contributed to Altimeter Capital's reputation as a top-performing investment firm.

Understanding the connection between "Title: Chief Executive Officer" and "Who Is Altimeter Capital Ceo" provides insights into the critical role of leadership in shaping a company's success. The CEO's vision, expertise, and decision-making directly impact the firm's investment strategy, financial performance, and overall reputation in the industry.

Experience

Within the context of "Who Is Altimeter Capital Ceo," the CEO's "Experience: Investment banking, private equity" holds significant relevance, shaping their investment decisions and overall leadership approach. This experience encompasses various facets, each contributing to the CEO's expertise and effectiveness in the role.

- Deal Execution: The CEO's experience in investment banking provides a deep understanding of deal structuring, negotiation, and execution, enabling them to secure favorable terms for Altimeter Capital's investments.

- Financial Analysis: A background in private equity equips the CEO with robust financial analysis skills, allowing them to evaluate potential investments, assess risk, and make informed decisions.

- Sector Expertise: Experience in specific industry sectors gives the CEO valuable insights into market trends, competitive landscapes, and emerging opportunities, guiding Altimeter Capital's investment strategy.

- Network and Relationships: The CEO's connections and relationships built during their investment banking and private equity careers provide access to industry leaders, potential investors, and deal flow.

These facets of experience collectively contribute to the CEO's ability to identify and execute successful investments, drive innovation, and navigate the complex world of venture capital. They underscore the importance of a CEO's background and expertise in shaping the success of a private equity firm like Altimeter Capital.

Education

Within the context of "Who Is Altimeter Capital Ceo," the CEO's education at Harvard Business School and Stanford University holds immense significance, shaping their leadership capabilities and strategic vision. This esteemed academic background encompasses several key facets that contribute to the CEO's success.

- Analytical Mindset: The rigorous academic environment at Harvard Business School and Stanford University fosters a strong analytical mindset, enabling the CEO to dissect complex business issues, evaluate data, and make informed decisions.

- Leadership Development: These institutions offer comprehensive leadership development programs, providing the CEO with the skills to inspire and motivate teams, build strong relationships, and navigate challenging situations effectively.

- Global Perspective: The diverse student body and international coursework at these universities broaden the CEO's perspective, allowing them to understand global markets and make informed investment decisions across borders.

- Alumni Network: The extensive alumni networks of Harvard Business School and Stanford University provide the CEO with access to a vast pool of industry leaders, potential investors, and business partners.

These facets of education collectively contribute to the CEO's ability to make strategic decisions, drive innovation, and navigate the complex world of venture capital. They underscore the importance of a CEO's educational background in shaping the success of a private equity firm like Altimeter Capital.

Investment Philosophy

Understanding the investment philosophy of Altimeter Capital's CEO is crucial in comprehending their approach to generating long-term value for investors. This philosophy centers around long-term, value-oriented investing, which encompasses several key facets:

- Patient Capital: Altimeter Capital invests with a long-term horizon, allowing their portfolio companies to execute their strategies without the pressure of short-term performance.

- Value Identification: The firm seeks to identify companies with intrinsic value that is not fully reflected in their current market price.

- Growth Potential: Altimeter Capital targets companies with significant growth potential, driven by strong competitive advantages and market opportunities.

- Active Engagement: The firm takes an active role in supporting its portfolio companies, providing strategic guidance and operational expertise to enhance their performance.

This investment philosophy has been instrumental in Altimeter Capital's success, enabling the firm to generate strong returns for its investors over the long term. It reflects the CEO's belief in the power of patient capital, value-driven decision-making, and active engagement in driving growth and unlocking the full potential of their investments.

Notable Investments

Within the context of "Who Is Altimeter Capital Ceo," the CEO's notable investments in Airbnb, Uber, and Snowflake hold significant relevance. These investments reflect the CEO's ability to identify and capitalize on transformative business models, contributing to Altimeter Capital's reputation as a top-performing investment firm.

- Disruptive Technologies: Altimeter Capital's investments in Airbnb, Uber, and Snowflake are characterized by their focus on disruptive technologies that have revolutionized their respective industries, creating new markets and changing consumer behavior.

- Growth Potential: These investments demonstrate the CEO's ability to recognize companies with significant growth potential, driven by strong market demand and a scalable business model.

- Value Creation: Altimeter Capital's active engagement with its portfolio companies has been instrumental in driving value creation, supporting their growth strategies and enhancing their operational efficiency.

- Long-Term Horizon: The CEO's long-term investment horizon has allowed these companies to execute their strategies without short-term pressures, fostering innovation and sustainable growth.

The CEO's notable investments in Airbnb, Uber, and Snowflake exemplify their investment philosophy and unwavering commitment to value creation. These investments have not only generated significant returns for investors but have also transformed industries and redefined consumer experiences.

Leadership Style

In examining "Who Is Altimeter Capital Ceo," the CEO's leadership style holds significant importance. The CEO's collaborative, data-driven approach has shaped the firm's culture and decision-making processes, contributing to its success.

- Collaborative Decision-Making: The CEO fosters a collaborative environment where diverse perspectives are valued and incorporated into decision-making. This approach encourages teamwork, innovation, and collective problem-solving.

- Data-Driven Insights: The CEO emphasizes data analysis and evidence-based decision-making. Data is used to evaluate investment opportunities, assess risks, and track performance, ensuring that decisions are informed and objective.

- Empowering Teams: The CEO empowers teams by providing autonomy and trust. This allows employees to take ownership of their work, fostering a sense of responsibility and accountability.

- Continuous Improvement: The CEO promotes a culture of continuous improvement and learning. Data is regularly reviewed to identify areas for optimization, and feedback is actively sought to enhance processes and strategies.

The CEO's collaborative, data-driven leadership style has created a cohesive and high-performing team at Altimeter Capital. It has enabled the firm to make informed decisions, adapt to changing market conditions, and achieve consistent success in its investments.

Industry Recognition

The industry recognition of Altimeter Capital's CEO as a top-ranked CEO in the technology sector is closely intertwined with the concept of "Who Is Altimeter Capital Ceo." This recognition serves as a testament to the CEO's exceptional leadership, strategic vision, and ability to drive success in the highly competitive technology industry.

A top ranking in the technology sector indicates that the CEO has consistently outperformed peers in terms of investment returns, innovation, and company growth. This recognition is a direct reflection of the CEO's expertise, experience, and ability to identify and capitalize on emerging trends and disruptive technologies.

The practical applications of understanding the connection between "Industry Recognition: Top-ranked CEO in the technology sector" and "Who Is Altimeter Capital Ceo" are numerous. Investors seeking high-growth opportunities in the technology sector can use this recognition as a valuable indicator of a CEO's capabilities and the potential success of their investments. Additionally, aspiring CEOs can learn from the leadership style and strategies of top-ranked CEOs to enhance their own effectiveness.

In conclusion, the industry recognition of Altimeter Capital's CEO as a top-ranked CEO in the technology sector is a significant factor that contributes to the firm's reputation and success. This recognition underscores the CEO's exceptional leadership skills, investment acumen, and ability to drive innovation, making them a highly sought-after partner for investors and a role model for aspiring CEOs in the technology industry.

In-depth exploration of "Who Is Altimeter Capital Ceo" reveals a multifaceted leader with a deep understanding of investment strategies, technology trends, and team dynamics. The CEO's expertise in investment banking, private equity, and education has shaped a collaborative, data-driven leadership style that fosters innovation and long-term value creation. Their notable investments in transformative companies like Airbnb, Uber, and Snowflake exemplify their ability to identify disruptive technologies and drive growth.

The recognition of the CEO as a top-ranked leader in the technology sector underscores their exceptional capabilities and the firm's commitment to excellence. As the venture capital landscape continues to evolve, Altimeter Capital and its CEO are well-positioned to navigate emerging trends, capitalize on new opportunities, and deliver superior returns to investors.

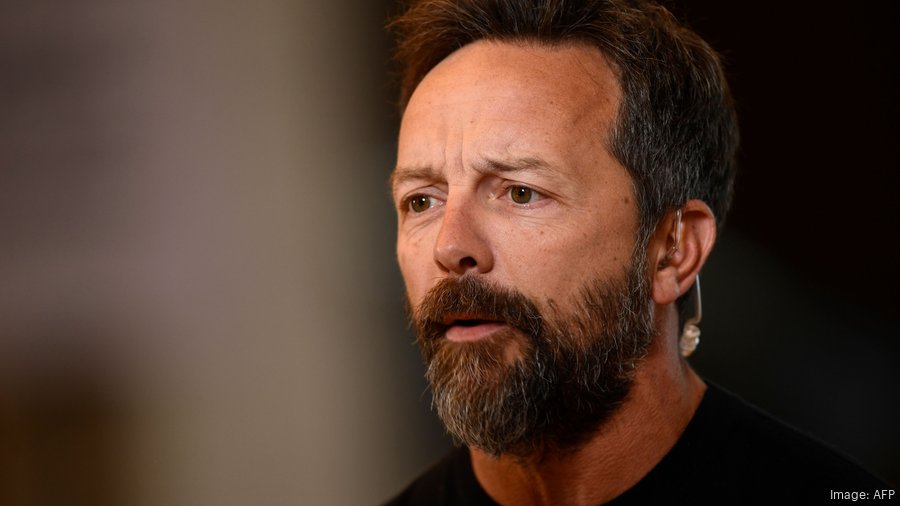

Altimeter Capital CEO Brad Gerstner on the A.I. arms race fueling the

Watch the interview with Altimeter Capital CEO Brad Gerstner

Silicon Valley VC Brad Gerstner to liquidate 450M SPAC Silicon