How To File Your SARS Income Tax Return Online

Navigating the complexities of filing your Income Tax Return can be a daunting task, but with SARS eFiling, you can simplify the process and ensure accuracy.

Filing your Income Tax Return accurately and on time is crucial to avoid penalties and ensure a smooth tax administration process. However, the complexities of tax laws and the need for meticulous record-keeping can make this task overwhelming.

SARS eFiling offers a user-friendly platform that guides taxpayers through the filing process, providing step-by-step instructions and eliminating the need for manual calculations. It also allows for secure submission of tax returns and provides instant confirmation, reducing the risk of errors and delays.

This article will delve into the benefits of using SARS eFiling, providing practical tips for seamless filing, and exploring the resources available to assist taxpayers throughout the process.

SARS eFiling for Income Tax Return

Filing Income Tax Returns accurately and on time is crucial for individuals and businesses. SARS eFiling offers a convenient and efficient platform for taxpayers to fulfill this obligation, addressing key aspects such as:

- Accessibility

- Accuracy

- Security

- User-friendliness

- Timeliness

- Transparency

- Support

- Compliance

These aspects are interconnected and essential for a seamless eFiling experience. Accessibility ensures that taxpayers can easily access the platform, while accuracy and security safeguard the integrity of the data submitted. User-friendliness simplifies the filing process, enabling taxpayers to navigate the system effortlessly. Timeliness is crucial for meeting filing deadlines and avoiding penalties. Transparency promotes trust and understanding of the tax process, while support provides guidance and assistance when needed. Compliance ensures adherence to tax regulations, and ultimately, eFiling contributes to the overall efficiency and effectiveness of tax administration.

How to Utilize SARS eFiling for Income Tax Return

Filing Income Tax Returns can be a daunting task, but SARS eFiling offers a solution to simplify the process. This user-friendly platform guides taxpayers through every step, ensuring accuracy and timely submission.

Benefits of SARS eFiling

- Convenient and accessible

- Accurate and secure

- User-friendly interface

- Timely filing

- Transparency and support

How to Get Started with SARS eFiling

To get started with SARS eFiling, taxpayers need to register on the SARS website and obtain a username and password. Once registered, they can access the eFiling platform and follow the step-by-step instructions provided.

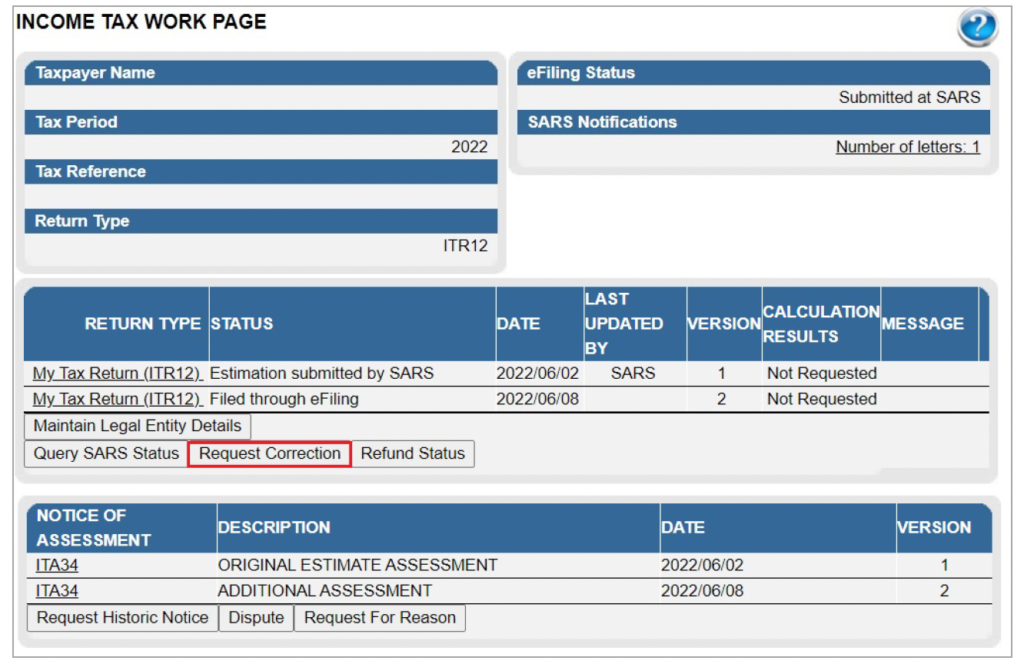

What Information is Required for SARS eFiling

Taxpayers will need to have their tax reference number, income and expenditure information, and any supporting documentation ready when filing their Income Tax Return through SARS eFiling.

Common Challenges Faced When Using SARS eFiling

While SARS eFiling is generally user-friendly, some common challenges that taxpayers may encounter include technical difficulties, understanding complex tax laws, and gathering all the necessary documentation.

Support Available for SARS eFiling

SARS provides various support channels to assist taxpayers using eFiling. These channels include a comprehensive online help section, email support, and a dedicated call center.

This article has delved into the intricacies of "SARS eFiling for Income Tax Return," providing valuable insights into its benefits, challenges, and effective utilization. Key points highlighted include the platform's accessibility, accuracy, security, and user-friendliness, which collectively contribute to a seamless eFiling experience for taxpayers.

However, it is important to recognize that understanding complex tax laws and gathering necessary documentation can pose challenges. To address these, SARS provides comprehensive support channels, including online help, email support, and a dedicated call center, empowering taxpayers to navigate the eFiling process with confidence.

- Amanda Schull Movies And Tv Shows

- Benjamin Levy Aguilar Net Worth

- Donovan Weatherspoon Net Worth How

when is tax season 2022 south africa Rosamaria Trapp

How to get a TAXNumber South Africa

How to file your personal taxes in 2023? Fincheck Academy