How Much Is Steven Williams Worth?

Steven Williams Net Worth How Much Is Steven refers to the total value of the assets owned by the individual named Steven Williams. It is typically calculated by summing up the value of all assets, including investments, property, and cash, and subtracting the value of all liabilities, such as outstanding loans and other debts.

Monitoring net worth is important for evaluating financial health and making informed decisions about investments and spending. Historically, tracking net worth has gained popularity as a tool for individuals to manage their wealth and achieve financial goals.

This article delves into the details of Steven Williams's net worth, exploring the components that contribute to his wealth, the factors that have influenced its growth, and the lessons that can be learned from his financial journey.

Steven Williams Net Worth How Much Is Steven

Key aspects related to "Steven Williams Net Worth How Much Is Steven" provide valuable insights into the financial standing and wealth management strategies of this individual. Understanding these aspects can be beneficial for those seeking to improve their own financial literacy and decision-making.

- Assets

- Investments

- Property

- Cash

- Liabilities

- Outstanding Loans

- Financial Health

- Investment Decisions

- Spending Habits

- Wealth Management

In conclusion, the key aspects outlined above offer a comprehensive view of Steven Williams's net worth. They highlight the importance of understanding the components of wealth, managing liabilities, and making informed financial decisions. By examining these aspects, individuals can gain valuable insights that can help them achieve their own financial goals.

Assets

Assets play a crucial role in determining Steven Williams's net worth. Assets are anything of value that Steven Williams owns and can convert into cash. These include investments such as stocks, bonds, mutual funds, and real estate, as well as personal property such as cars, jewelry, and artwork. The value of Steven Williams's assets contributes directly to his overall net worth.

For instance, if Steven Williams owns a house worth $500,000 and has $100,000 in stocks, his assets total $600,000. This amount would be included in the calculation of his net worth. Conversely, if Steven Williams has significant debts, such as a mortgage on his house or outstanding loans, these liabilities would be deducted from his assets to arrive at his net worth.

Understanding the relationship between assets and net worth is essential for Steven Williams to make informed financial decisions. By carefully managing his assets and liabilities, he can increase his net worth over time. This can provide him with greater financial security and flexibility, allowing him to achieve his financial goals.

Investments

Investments are an integral component of Steven Williams's net worth. They represent a portion of his assets that are allocated to various financial instruments with the potential to generate income or appreciate in value over time. By investing, Steven Williams aims to grow his wealth and secure his financial future.

- Stocks

Stocks represent ownership shares in publicly traded companies. When Steven Williams invests in stocks, he becomes a shareholder and has the potential to earn dividends and benefit from capital appreciation if the company performs well.

- Bonds

Bonds are loans that Steven Williams makes to companies or governments. In return, he receives regular interest payments and the repayment of the principal amount at maturity. Bonds typically offer lower returns than stocks but are generally considered less risky.

- Mutual Funds

Mutual funds are professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Investing in mutual funds can provide Steven Williams with instant diversification and the benefits of professional money management.

- Real Estate

Real estate encompasses land and any buildings or structures on it. Steven Williams may invest in residential or commercial properties to generate rental income, appreciate in value, or both. Real estate investments can be complex and require careful consideration, but they have the potential to provide substantial returns.

Overall, Steven Williams's investment strategy and the performance of his investments directly impact his net worth. By diversifying his portfolio across different asset classes and carefully managing his risk, he can maximize his chances of achieving his financial goals.

Property

Property, a tangible asset class, plays a significant role in determining Steven Williams' net worth. It encompasses land, buildings, and other improvements that Steven Williams owns, each with its own unique set of characteristics and value.

Property can be a substantial contributor to Steven Williams' overall net worth. For instance, if he owns a residential property worth $500,000 and a commercial property worth $1 million, his property assets alone would amount to $1.5 million. Additionally, property can generate income through rent or appreciation in value, further boosting his net worth over time.

Investing in property requires careful consideration of factors such as location, market trends, and potential return on investment. However, when managed wisely, property can provide Steven Williams with long-term financial security and stability. It can also serve as a hedge against inflation and economic downturns.

In summary, property is a critical component of Steven Williams' net worth, offering the potential for significant wealth accumulation and income generation. Understanding the connection between property and net worth empowers Steven Williams to make informed investment decisions and build a solid financial foundation.

Cash

Cash, while often overlooked, is a critical component of Steven Williams' net worth. Cash represents the most liquid of all assets, providing immediate access to funds for various purposes. Its importance stems from its versatility and availability during times of need.

For instance, if Steven Williams has $100,000 in cash, he can use it to cover unexpected expenses, seize investment opportunities, or make large purchases without incurring debt. This financial flexibility contributes significantly to his overall wealth management strategy.

Furthermore, cash serves as a buffer against financial emergencies and economic downturns. When other assets may experience fluctuations in value, cash provides a stable foundation, allowing Steven Williams to weather financial storms without compromising his long-term goals.

In essence, a healthy cash position is a cornerstone of Steven Williams' financial well-being. It provides liquidity, flexibility, and security, enabling him to make informed decisions and navigate financial challenges effectively.

Liabilities

Liabilities are an essential aspect of Steven Williams' net worth, representing obligations or debts that reduce the overall value of his assets. Understanding the different types of liabilities and their implications is crucial for assessing his financial health and making informed decisions.

- Outstanding Loans

Loans, such as mortgages or personal loans, constitute a major liability for Steven Williams. These obligations require regular payments of principal and interest, affecting his cash flow and overall net worth.

- Credit Card Debt

Credit card balances can accumulate quickly and become a significant liability if not managed properly. High credit card debt can damage Steven Williams' credit score and increase the cost of borrowing in the future.

- Taxes Payable

Taxes, such as income tax or property tax, are legal obligations that reduce Steven Williams' net worth. Timely payment of taxes is crucial to avoid penalties and maintain a positive relationship with tax authorities.

- Accounts Payable

For businesses owned by Steven Williams, accounts payable represent outstanding payments to suppliers or vendors. Managing accounts payable effectively ensures smooth business operations and maintains good relationships with creditors.

In summary, liabilities play a crucial role in determining Steven Williams' net worth. By carefully managing his liabilities, such as outstanding loans, credit card debt, taxes payable, and accounts payable, he can maintain a healthy financial position, reduce the risk of financial distress, and maximize his overall wealth.

Outstanding Loans

Outstanding loans represent a significant aspect of Steven Williams' net worth, directly impacting its overall value. These obligations require regular payments, affecting his cash flow and financial flexibility.

- Mortgage Loans

Mortgages are loans secured by real estate, typically used to finance the purchase of a home. They constitute a major liability for Steven Williams, affecting his net worth and monthly expenses.

- Personal Loans

Personal loans are unsecured loans used for various purposes, such as debt consolidation or unexpected expenses. They often carry higher interest rates than secured loans, increasing the overall cost of borrowing for Steven Williams.

- Business Loans

Business loans are used to finance business operations, such as expansion or equipment purchases. These loans can be secured or unsecured, and their terms vary depending on the lender and purpose of the loan.

- Credit Card Debt

Credit card debt, while technically a revolving line of credit, is often considered a type of outstanding loan due to its potential to accumulate high interest charges. Managing credit card debt effectively is crucial for Steven Williams to maintain a healthy net worth.

In conclusion, outstanding loans are a multifaceted aspect of Steven Williams' net worth, influencing his financial situation in various ways. Understanding the different types of loans, their terms, and their impact on cash flow is essential for Steven Williams to make informed financial decisions and optimize his net worth over time.

Financial Health

Financial health is a crucial aspect of Steven Williams' net worth, indicating the overall soundness of his financial situation. A healthy financial standing not only reflects his current wealth but also his ability to sustain and grow his net worth over time.

- Assets and Liabilities

Evaluating the balance between Steven Williams' assets and liabilities provides insights into his financial leverage and risk profile. A higher proportion of assets relative to liabilities generally indicates a stronger financial position.

- Cash Flow

Steven Williams' cash flow, or the movement of money in and out of his accounts, is a key indicator of his financial health. Consistent positive cash flow ensures that he has sufficient liquidity to meet his obligations and pursue opportunities.

- Debt Management

Steven Williams' debt management practices, including his debt-to-income ratio and credit utilization, influence his financial health. High levels of debt or excessive use of credit can strain his cash flow and limit his access to future borrowing.

- Investment Strategy

The soundness of Steven Williams' investment strategy contributes to his financial health. Diversification, risk tolerance, and long-term planning are key factors that influence the stability and growth of his investments.

By understanding and managing these facets of financial health, Steven Williams can proactively strengthen his financial position, preserve his net worth, and achieve his long-term financial goals. Conversely, neglecting these aspects can lead to financial distress, reduced net worth, and limited opportunities.

Investment Decisions

Investment decisions play a critical role in determining and growing Steven Williams' net worth. By strategically allocating his assets into various investment vehicles, he can potentially increase his wealth over time. These decisions involve carefully considering risk tolerance, investment goals, and market trends.

For instance, if Steven Williams invests in a diversified portfolio of stocks and bonds, he aims to balance potential returns with risk. Stocks offer higher growth potential but also carry more risk, while bonds provide stability and income but with lower returns. By understanding the relationship between risk and return, Steven Williams can make informed investment decisions that align with his financial goals.

Furthermore, Steven Williams' investment decisions can have a direct impact on his net worth. If his investments perform well and appreciate in value, his net worth will increase. Conversely, if his investments underperform or lose value, his net worth will decrease. Therefore, making sound investment decisions is essential for Steven Williams to preserve and grow his wealth.

In summary, investment decisions are a crucial aspect of Steven Williams' net worth. By understanding the connection between his investment decisions and the subsequent impact on his net worth, he can make informed choices that align with his financial goals and increase his chances of achieving long-term financial success.

Spending Habits

Understanding Steven Williams' spending habits is crucial in assessing his net worth. Spending habits directly influence the accumulation and preservation of wealth, impacting his overall financial well-being.

- Discretionary Spending

Discretionary spending refers to expenses that are not essential for survival, such as entertainment, dining out, and travel. Steven Williams' discretionary spending habits can provide insights into his lifestyle choices and priorities.

- Savings Rate

The savings rate measures the percentage of income that Steven Williams sets aside for future use. A high savings rate indicates a focus on long-term financial goals and a commitment to building wealth.

- Debt Management

Steven Williams' debt management practices, including credit card usage and loan repayments, reveal his ability to manage debt responsibly. Excessive debt can strain his cash flow and hinder his net worth growth.

- Investment Allocation

The allocation of Steven Williams' spending towards investments, such as stocks or real estate, demonstrates his risk tolerance and investment strategy. Investment decisions can significantly impact the growth of his net worth over time.

In summary, analyzing Steven Williams' spending habits provides valuable insights into his financial behavior, risk tolerance, and long-term financial goals. By understanding these aspects, we can better grasp the factors that contribute to his net worth and assess his overall financial health.

Wealth Management

Wealth management encompasses the strategies and practices employed by individuals to manage and grow their financial assets. Within the context of "Steven Williams Net Worth How Much Is Steven," wealth management plays a crucial role in determining the overall value and trajectory of his wealth.

- Asset Allocation

Asset allocation refers to the distribution of an investment portfolio among different asset classes, such as stocks, bonds, and real estate. Steven Williams' asset allocation strategy reflects his risk tolerance, investment goals, and time horizon, influencing the growth and stability of his net worth.

- Investment Management

Investment management involves actively managing investment portfolios to maximize returns and minimize risks. Steven Williams' investment manager makes decisions on buying, selling, and holding investments, aiming to enhance the performance of his portfolio and contribute to his overall net worth growth.

- Tax Planning

Tax planning strategies are designed to optimize tax efficiency and minimize tax liabilities. Steven Williams' tax planning measures aim to reduce the impact of taxes on his investments and net worth, allowing him to retain more of his wealth.

- Estate Planning

Estate planning involves making arrangements for the distribution of assets after death. Steven Williams' estate plan ensures that his assets are distributed according to his wishes, minimizing estate taxes and providing for his beneficiaries' financial security after his passing.

These facets of wealth management are intricately connected and work together to preserve and grow Steven Williams' net worth. By understanding and implementing effective wealth management strategies, he can navigate financial markets, mitigate risks, and maximize the potential returns on his investments, ultimately contributing to the long-term growth of his wealth.

In exploring "Steven Williams Net Worth How Much Is Steven," we have gained valuable insights into wealth management strategies and their impact on net worth growth. Understanding the interplay between asset allocation, investment management, tax planning, and estate planning provides a comprehensive view of how individuals can effectively manage their financial assets. The key points highlighted throughout this article underscore the importance of setting clear financial goals, making informed investment decisions, and implementing a disciplined approach to wealth management.

To navigate the complexities of wealth management, consider seeking guidance from financial advisors or wealth managers who can tailor strategies to meet your specific needs and circumstances. Remember that net worth is not solely defined by the accumulation of wealth but also encompasses financial stability, risk management, and long-term financial security. By embracing a proactive approach to wealth management, individuals can empower themselves to make informed financial choices and achieve their long-term financial aspirations.

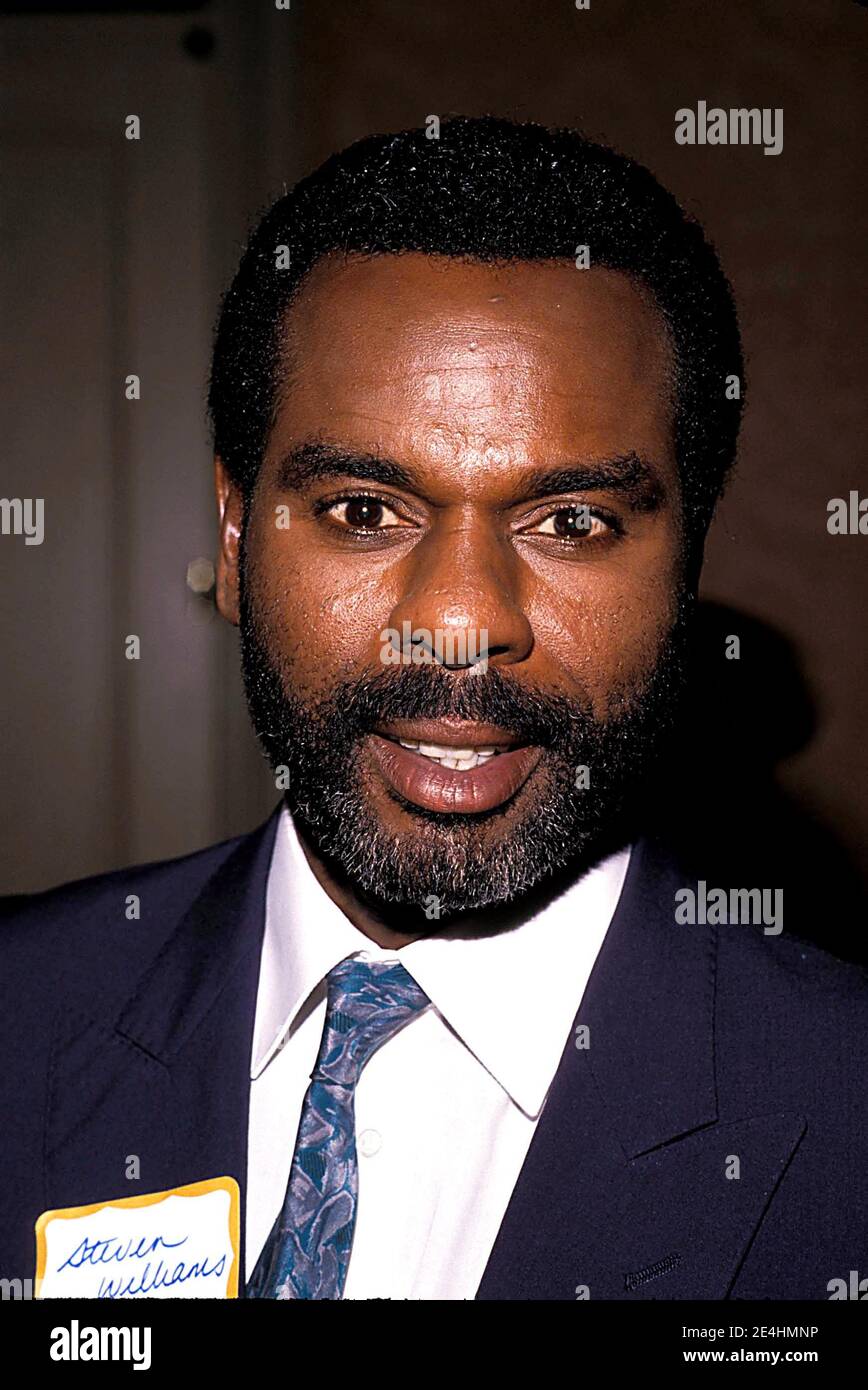

Steven Williams IMDb

Steven Williams Credit Ralph Dominguez/MediaPunch Stock Photo Alamy

Steven Williams Net Worth, Biography, and Insider Trading